Currently, natural disasters caused by climate change may increase, and there are concerns about the financial impact on companies as well as the impact on society.

To address these issues, TCFD* which was established by Financial Stability Board (FSB), released its Final Report in June 2017, which contains recommendations on the disclosure of information to stakeholders concerning the risks and opportunities from climate change for companies in four thematic areas: Governance, Strategy, Risk Management, and Metrics and Targets. Furthermore, the movement towards sustainability information disclosure is accelerating, with the Sustainability Standards Board of Japan (SSBJ) being established within the Financial Accounting Standards Foundation (FASF) in 2022.

Shimizu recognizes the impacts from climate change on our businesses as an important management issue, and has determined that the disclosure of related information is essential from the perspective of sustainability. We endorsed the TCFD recommendations and joined the TCFD Consortium in October 2019, and disclosed climate-related information in line with the recommendations from 2020.

TCFD: Task Force on Climate-related Financial Disclosures

TCFD Recommendations: Thematic Areas of Climate-related Information Disclosure

| Governance | the organization’s governance around climate-related risks and opportunities. |

|---|---|

| Strategy | the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning. |

| Risk Management | the processes used by the organization to identify, assess, and manage climate-related risks. |

| Metrics and Targets | the metrics and targets used assess and manage relevant climate-related risks and opportunities. |

Source: Practical guide for Scenario Analysis in line with the TCFD recommendations, Ministry of the Environment, Government of Japan, March 2021

Governance

In SHIMZ VISION 2030 and Mid-Term Business Plan〈2024-2026〉, Shimizu and its group companies (hereafter, the “Shimizu Group”) have positioned environmental issues, including climate change, as one issue that will have a material impact on management.

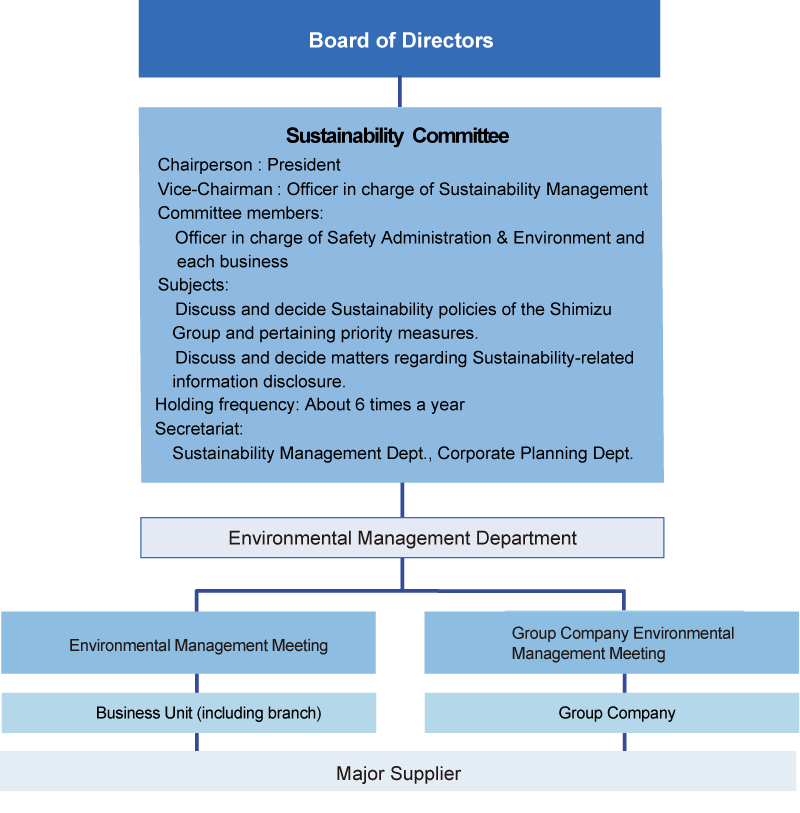

We have also deliberated on basic policies and measures concerning environmental issues by the Sustainability Committee (Chairman: President). This committee is chaired by the officer in charge of SDGs/ESG, and consists of the officers in charge of various areas such as the officer in charge of Safety Administration and Environment. The committee deliberates on the results of specification and evaluation of climate-related risks and opportunities and also manages progress on achieving the greenhouse gas (CO2) emission targets in Ecological Mission 2030-2050. The results of these deliberations are reported to the Board of Directors for supervision. Furthermore, the Environmental Strategy Office, which is under the direct control of the company president, supervise activities and initiatives for achieving Environmental Vision ‘SHIMZ Beyond Zero 2050’ .

Important decisions on environmental issues in the Shimizu Group are communicated to business divisions (including branches) and Group companies through Environmental Management Supervisors Committee and Group Company Environmental Management Supervisors Council. Shimizu is also building an environmental governance structure that includes its main suppliers.

Shimizu Group Governance Structure for Environmental Issues

Strategy

The climate-related risks and opportunities that may affect the Shimizu Group’s business include those related to the transition to a zero-carbon society, such as stronger policies and regulations and shifts in the market, as well as physical changes caused by global warming, both acute and chronic. Under the Japanese government’s commitment to achieving carbon neutrality by 2050, the Cabinet approved several major policies in February 2025, including the GX2040 Vision, the Seventh Strategic Energy Plan, and the revised Global Warming Countermeasures Plan. These developments require business model transformation and changes in industrial structures, and the market and broader social environment are already beginning to shift.

Taking these market and societal changes into account, we identify and categorize risks and opportunities related to both transition and physical changes as impacts on procurement, direct operations, and product demand. We then assess the scale of their impact, the expected timing, and how the Shimizu Group should respond.

In FY2024, we added certain new scenarios and reviewed the impact levels, timing, and selected responses for key factors, reflecting both our analysis and the latest domestic and international trends. The updates are as follows:

- To reference scenarios with more current and ambitious targets, we added to our transition scenarios an NZE2050 scenario, which limits global temperature rise by the end of the century to below 1.5°C relative to pre-industrial levels, and we revised the assumed carbon price

- Reviewed impact levels, impact timing, and related elements based on the results of this scenario analysis and the latest domestic and international trends

- Added disclosure on avoided emissions

(1) Adopted scenarios

In examining risks and opportunities related to “transition” and “physical changes,” we adopt the following representative scenarios.

- Transition scenarios: Among the scenarios formulated by the International Energy Agency (IEA),

- a scenario that limits the temperature rise at the end of this century to well below 2°C compared with before the Industrial Revolution (SDS)

- a scenario that limits the temperature rise at the end of this century to below 1.5°C compared with before the Industrial Revolution (NZE2050)

- Physical scenario: Among the scenarios formulated by the Intergovernmental Panel on Climate Change (IPCC),

- a scenario in which temperature rise at the end of this century exceeds 4°C compared with before the Industrial Revolution (RCP8.5)

- Carbon price: Updated from 130$/t-CO2 to 140$/t-CO2

(2) Scenario Analysis Results

Impact levels for each risk and opportunity are categorized as large, medium, or small based on the assumed relative financial impact on our business. Impact timing is classified as short-, mid-, or long-term, reflecting when each risk or opportunity is expected to have its strongest effect.

The scenario analysis identified seven factors with a significant impact level. For transition risks, the factor was the strengthening of regulations to achieve a zero-carbon society. For transition opportunities, the factors were the growing demand for energy-efficient buildings and the expanding demand for renewable energy. For physical risks, the factors were rising average summer temperatures and the increasing frequency and severity of weather-related disasters. For physical opportunities, the factors were strengthened national resilience policies and market changes driven by climate change.

Strengthening regulations to achieve a zero-carbon society creates significant risk of reduced demand for new buildings in the medium term, particularly as policies advance toward mandatory CO₂ disclosure across the building life cycle. At the same time, a short- to medium-term increase in demand for energy-efficient buildings is also expected. In practice, demand for ZEB continues to rise each year. Drawing on our extensive experience in ZEB design, construction, and certification, we will continue to support wider adoption, including renovation ZEB through sustainable renovation.

We also view the expanding demand for renewable energy as a significant business opportunity for the Shimizu Group. Among renewable energy sources, we are focusing on offshore wind power, which offers substantial potential for scale and stable generation. To support this market, we own BLUE WIND, a dedicated SEP vessel* used for offshore wind farm construction. BLUE WIND is among the world’s most capable vessels and is designed to withstand Japan’s demanding sea conditions. We have signed time charter agreements with overseas power producers and contractors, and the vessel has been in operation since March 2025 on the Hai Long offshore wind farm project off the coast of Changhua, Taiwan. We intend to maximize its operational availability by expanding opportunities in both the Asian and Japanese markets.

To meet the growing need for taller, larger onshore wind turbines prompted by the recent expanding demand for renewable energy, we have also developed a dedicated mobile tower crane, the S-Movable Tower crane, in collaboration with IHI Transport Machinery Co., Ltd. and our group company, SC Machinery Co., Ltd. As of June 2024, it is Japan’s largest and highest-performing free-standing tower crane and can support the construction of large onshore wind turbines in the 5–6 MW class.

SEP vessel refers to a Self-Elevating Platform vessel, a self-elevating work vessel.

We view rising average summer temperatures as a serious issue, as they lead to deteriorating working conditions, further exacerbate shortages of skilled labor, and increase the risk of workplace accidents. In response, the Shimizu Group is implementing measures such as promoting labor-saving and productivity improvement at work sites through the use of robots and other technologies, as well as improving working conditions through ongoing workstyle reforms.

The increasing frequency and severity of weather-related disasters are also major concerns, particularly in light of 2024 being the hottest year on record, with global temperatures rising 1.6 °C above pre-industrial levels for the first time, and the growing occurrence of localized torrential downpours. In addition to reinforcing disaster-prevention measures in temporary site planning and site operations, we are strengthening collaboration with suppliers. To address procurement difficulties involving materials and labor, and potential impacts on construction schedules, we believe fostering understanding among clients through industry associations will be essential.

Strengthened national resilience policies present a significant business opportunity by expanding infrastructure development. We are continuing to reinforce our order-acquisition efforts and are working to build a flexible structure capable of responding swiftly to reconstruction needs in the event of a disaster.

We are also advancing a range of initiatives to capture market changes driven by climate change as business opportunities. In the short term, this includes supporting the development of flood timeline disaster-prevention plans for existing buildings. In the medium to long term, we are developing floating structure technologies in anticipation of rising sea levels and investing in space startup companies working to commercialize carbon dioxide monitoring using satellite data.

Reflecting the TNFD disclosure recommendations introduced in 2024, we have examined nature-related impacts alongside key climate-related risks and opportunities and have included these considerations in the rightmost column of the table. Our analysis shows that some factors viewed as opportunities from a climate perspective may present risks from a nature-related perspective, and some factors considered climate-related risks may present nature-related opportunities. We also identified cases where climate-related risks and opportunities align with nature-related risks and opportunities. We regard both climate-related and nature-related issues as important management priorities and will work to mitigate risks and maximize opportunities in both areas.

(3) Estimated Financial Impact

1) Financial value of emissions reductions

We calculated the financial value that would be generated if our CO2 reduction targets for Scope 1 and Scope 2 are achieved through our planned reduction measures. Based on the FY2024 target, the value is 273 million yen, and for FY2035 it amounts to 4,072 million yen.

Viewed from another perspective, these figures represent the additional costs that would arise if the targets were not achieved. Since the Shimizu Group is already advancing Scope 1 and Scope 2 reduction measures, we expect to meet the targets. The costs incurred to date for these initiatives have been lower than the carbon price used in the current estimate, which is 140$/t-CO2 at an exchange rate of 1$ = 150 yen.

- Scope 1 reduction measures:

-

In FY2024, we were selected for the Business Promotion Support Project for the Use of Biofuel, offered by the Tokyo Metropolitan Government. At our construction sites, we will introduce 100 percent biofuel for construction machinery, and the cost difference relative to standard diesel fuel will be subsidized.

- Scope 2 reduction measures:

-

From FY2024 onward, electricity used at newly commenced domestic construction sites will be sourced entirely from renewable energy. We aim to achieve zero CO₂ emissions from electricity used in construction work by FY2030, and eventually extend this initiative to construction sites overseas and those operated by Group companies.

| Category | FY2023 | Case where FY2024 targets are achieved | Case where FY2035 targets are achieved | ||||

|---|---|---|---|---|---|---|---|

| Baseline emissions (t-CO2) |

Target emissions (t-CO2) |

Reduction amount (t-CO2) |

Monetary conversion*2 (million yen) |

Target emissions (t-CO2) |

Reduction amount (t-CO2) |

Monetary conversion*3 (million yen) |

|

| Scope1+Scope2 | 325,340 | 312,326 | 13,014 | 273 | 131,426 | 193,914 | 4,072 |

- Scope: Shimizu Group Japan and overseas consolidated

- FY2024: 13,014 [t-CO2] × 140 [$/t-CO2] × 150 [yen/$] = 273 million yen

- FY2035: 193,914 [t-CO2] × 140 [$/t-CO2] × 150 [yen/$] = 4,072 million yen

2) Financial Value of Avoided Emissions

For CO2 reduction achieved through our technologies and design-build projects that is not included in Scope 1, Scope 2, or Scope 3, we define this reduction as the Shimizu Group’s “avoided emissions.” For the two initiatives listed below, we calculated both the volume of avoided emissions and the corresponding financial value.

- Promotion of energy-efficient buildings:

-

We compared the energy performance of design-build projects for which building confirmation applications were submitted in FY2024, including ZEB and other energy-efficient buildings, with that of standard buildings that met legal requirements in FY2013.

- Construction of offshore wind farms:

-

We compared the CO2 emissions associated with the electricity generated by offshore wind farms completed and handed over in FY2024 with emissions from electricity generated using fossil fuels.

| Case | Avoided emissions [t-CO2] | Financial value (million yen)*6 | |

|---|---|---|---|

| Avoided emissions (FY2024 results) |

Promotion of energy-efficient buildings | 602,600*4 | 12,655 |

| Construction of offshore wind farms | 4,949,400*5 | 103,937 | |

- *4 Avoided amount based on comparison with a standard building; 12,052 t-CO2/year × 50 years (operational period)

- *5 Annual expected power generation; 565 [GWh/year] × average operational period; 20 [years] × national average emission factor; 0.438 [t-CO2/MWh]

- *6 Financial value = Avoided emissions [t-CO2] × 140 [$/t-CO2] × 150 [yen/$]

Risk Management

Through our group-wide risk management framework and processes, we identify climate change as a key risk. Under the Group Environmental Vision SHIMZ Beyond Zero 2050, we aim to minimize environmental risks, including those related to climate change, and maximize associated opportunities.

The Sustainability Committee reviews climate-related risks, and important matters are reported to the Board of Directors. Measures for responding to these risks are communicated across the entire company and to group companies. As part of our risk management for global warming, the committee also sets CO₂ reduction targets for our business activities and determines the specific actions needed to meet those targets, such as shifting construction site energy use from diesel to electricity and expanding the use of renewable energy-derived electricity. The committee also regularly monitors CO₂ emissions. Through these risk management efforts, we will continue to address climate change risks, which are expected to become increasingly diverse, widespread, and severe.

Metrics and Targets(Based on consolidated companies in Japan and overseas combined)

Within the Group, total CO2 emissions serve as a key indicator for assessing and managing the impact of climate-related risks on management. Based on SBT*, the Group has established mid-term CO2 reduction targets and a long-term net zero target. These targets were certified by the SBTi in October 2025.

SBT: Science Based Targets

Company targets for reduction in greenhouse gas emissions that are in line with scientific knowledge and aimed

at controlling the rise in average global temperature to lower than 1.5℃.

- News release: “2050 Net Zero” CO2 Reduction Targets Receive SBT Certification (Only in Japanese)

- SBT Certificate

| Scope | Base year emissions | Actual emissions | Target annual emissions | ||

|---|---|---|---|---|---|

| Fiscal 2023 | Fiscal 2024 | Fiscal 2024 | Fiscal 2035 | Fiscal 2050*2 | |

| Scope 1+ Scope 2 |

325,340 | 314,731 (▲3.3%) |

310,328 (▲4%) |

127,696 (▲61%) |

0 (▲100%) |

| Scope 3 (Category 1+11*1) |

9,451,379 | 3,480,511 | - | 5,818,505 (▲38%) |

0 (▲100%) |

- Scope 3 Category 1: (Purchased products and services) CO2 emissions from the manufacturing of

construction materials and other purchased goods

Scope 3 Category 11: (Use of products sold) CO2 emissions from the operation of buildings constructed by Shimizu

In addition, emissions from non-major materials were added to Category 11, and the category was revised to include only projects designed in-house. - SBT reduction target: 90%. Remaining emissions will be offset through Carbon Dioxide Removal (CDR) and other technologies.