Currently, natural disasters caused by climate change may increase, and there are concerns about the financial impact on companies as well as the impact on society.

To address these issues, TCFD which was established by Financial Stability Board (FSB), released its Final Report in June 2017, which contains recommendations on the disclosure of information to stakeholders concerning the risks and opportunities from climate change for companies in four thematic areas: Governance, Strategy, Risk Management, and Metrics and Targets. Furthermore, the movement towards sustainability information disclosure is accelerating, with the Sustainability Standards Board of Japan (SSBJ) being established within the Financial Accounting Standards Foundation (FASF) in 2022.

Shimizu recognizes the impacts from climate change on our businesses as an important management issue, and has determined that the disclosure of related information is essential from the perspective of sustainability. We endorsed the TCFD recommendations and joined the TCFD Consortium in October 2019, and disclosed climate-related information in line with the recommendations from 2020.

TCFD: Task Force on Climate-related Financial Disclosures

TCFD Recommendations: Thematic Areas of Climate-related Information Disclosure

| Governance | the organization’s governance around climate-related risks and opportunities. |

|---|---|

| Strategy | the actual and potential impacts of climate-related risks and opportunities on the organization’s businesses, strategy, and financial planning. |

| Risk Management | the processes used by the organization to identify, assess, and manage climate-related risks. |

| Metrics and Targets | the metrics and targets used assess and manage relevant climate-related risks and opportunities. |

Source: Practical guide for Scenario Analysis in line with the TCFD recommendations, Ministry of the Environment, Government of Japan, March 2021

Governance

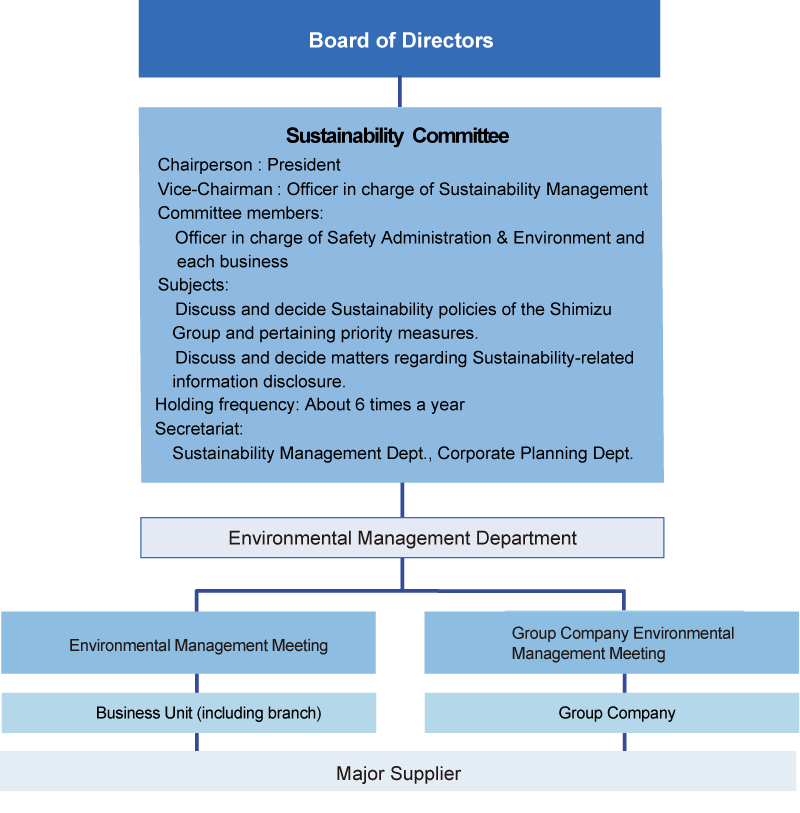

In SHIMZ VISION 2030 and Mid-Term Business Plan〈2024-2026〉, Shimizu and its group companies (hereafter, the “Shimizu Group”) have positioned environmental issues, including climate change, as one issue that will have a material impact on management. We have also deliberated on basic policies and measures concerning environmental issues by the Sustainability Committee (Chairman: President). This committee is chaired by the officer in charge of SDGs/ESG, and consists of the officers in charge of various areas such as the officer in charge of Safety Administration and Environment. The committee deliberates on the results of specification and evaluation of climate-related risks and opportunities and also manages progress on achieving the greenhouse gas (CO2) emission targets in Ecological Mission 2030-2050. The results of these deliberations are reported to the Board of Directors for supervision. Furthermore, the Environmental Strategy Office, which is under the direct control of the company president, supervise activities and initiatives for achieving Environmental Vision ‘SHIMZ Beyond Zero 2050’ .

Important decisions on environmental issues in the Shimizu Group are communicated to business divisions (including branches) and Group companies through Environmental Management Supervisors Committee and Group Company Environmental Management Supervisors Council. Shimizu is also building an environmental governance structure that includes its main suppliers.

Shimizu Group Governance Structure for Environmental Issues

Strategy

Climate-related risks and opportunities that impact Shimizu Group businesses include those concerning strengthening the policies and regulations needed to build a zero-carbon society and market changes and other transitions. It can also include acute and chronic physical changes due to global warming.The policy expressed by the Japanese government of achieving carbon neutrality by 2050 will necessitate innovations in business models and transformation of industrial structure. Changes are already happening in the market and social environment.

Shimizu launched the company-wide, cross-organizational TCFD Working Group to extract and categorize the risks and opportunities presented by these transitions and physical changes as impacts on each level: procurement, direct operations, and product demand. The Working Group are analyzing the impact, the period of impact and the response of the Shimizu Group. The degree of impact is broken down into three levels: ↓↓↓ (large), ↓↓ (medium), and ↓ (small) for risks and ↑↑↑ (large), ↑↑ (medium), and ↑ (small) for opportunities. This is based on the assumed relative significance of the financial impact on business activities.In addition, the period over which each risk and opportunity is expected to have a strong impact is estimated based on scenario analysis and other factors. The periods are classified and disclosed as short term, medium term, or long term. (Short term: 3 years or less; medium term: more than 3 years and up to 10 years; long term: more than 10 years)

The typical scenarios below were used when looking into the risks and opportunities related to transition and physical change.

The following representative scenarios were also used to examine the risks and opportunities in transitions and physical changes.

- Transition Scenario: One of the International Energy Agency (IEA) scenarios in which the rise in temperature at the end of this century is Less than 1.5°C, compared to before the industrial revolution (SDS)

- Physical Scenario: One of the Intergovernmental Panel on Climate Change (IPCC) scenarios in which the rise in temperature by the end of this century exceeds 4℃, compared to before the industrial revolution (RCP 8.5)

Analysis of resolts, as factors that would cause a large impact, the working group selected the four factors of “expansion in the need for energy-efficient buildings,” “expansion in the need for renewable energy,” “policies that improve national resilience,” and “Market changes brought about by climate change,” as opportunities, and the single factor of “rise in summer average temperature” as a risk. In particular, we recognize risks such as heat stroke associated with higher average temperatures in the summer as a material issue that lead to deterioration of the working environment, etc. The Shimizu Group is thus implementing measures such as the promotion of labor savings and improved productivity through the utilization of robots and other technology and improvement of the working environment through the realization of work style reform and other initiatives. On the other hand, we recognize that “expansion in the need for renewable energy” is a tremendous business opportunity for the Shimizu Group. We have placed our focus on offshore wind power generation, which is one of the most promising renewable energy sources due to the scale and stability of its power generation. For this reason, we have built a dedicated SEP vessel, BLUE WIND*, for use in the construction of offshore wind farms. BLUE WIND boasts world-class work capacity and can withstand even the severe marine weather conditions in Japan. It offers an operating rate about 50% higher than regular work barges. We are also looking into using heavy fuel oil alternatives in the future. The vessel was first used off the coast of Nyuzen-machi, Shimo-Niikawa-gun, Toyama. It is used to construct an offshore wind farm at Ishikari Bay New Port in Hokkaido. We expect to continue to receive orders for the construction of renewable energy facilities based on wind power generation. Making full use of this vessel, the Shimizu Group will address the growing demand for renewable energy.

SEP ship: An abbreviation of Self-Elevating Platform vessel. A SEP vessel is a working ship with a self-elevating platform.

Blue Wind specifications: total length 142m, total width 50m, gross tonnage 28,000t, main crane lifting capacity 2500t, maximum lifting height 158m

We conducted a quantitative assessment of financial impact with regard to the introduction of carbon pricing. (The amount was the assumption that it will apply to the entire amount of Scope 1 and 2 CO2 emissions 214,709t-CO2 of the Shimizu Group (consolidated companies in Japan) in FY2022). In addition, the carbon price was estimated at $130, set by IEA.

The estimated financial impact of direct emisions

- ¥4,187 million yen (214,709 t-CO2 x $130 (IEA carbon price) x ¥150 [exchange rate of ¥150 to the dollar])

This estimate assumes that it will apply to total CO2 emissions. The actual amount will probably be smaller than this. In addition, even if prices of construction materials and other items increase due to the introduction of carbon pricing, we expect the impact to be small assuming that the increase is passed on to construction prices. In light of the above, we assess the impact of the introduction of carbon pricing to be ↓ (small). Additionally, we are promoting the reduction of CO2 emitted during construction. Scope 1+2 CO2 emitted by the Shimizu Group (domestic consolidated) in fiscal 2017, the base year, was 275,575t-CO2, and if we achieve a 33% reduction in emissions (our medium-term reduction target) in fiscal 2030, The amount of reduction is 90,940t-CO2, and the value of this reduction is below:

90,940t-CO2 x $130 (IEA carbon price) x ¥150= 1,773 million yen

The Japanese government has announced a policy to gradually introduce a carbon fee system and an emissions trading system around fiscal 2028. There is also a possibility that CO2 emission reductions will become a requirement for taking private construction orders. The Shimizu Group is implementing various measures to maintain and enhance our competitiveness in response to the impact that greater weight being given to assessments of efforts to reduce CO2 emissions is having on opportunities to win orders. This includes the introduction of a CO2 monitoring system for all sites, the promotion of use of electricity derived from renewable energy sources and alternatives to diesel fuel, the development of a CO2 emissions forecasting platform for building construction and production (materials + construction), and the promotion of the use of electric furnace steel in design and construction projects.

In addition, we also considered nature-related impacts for the main climate-relate risks and opportunities we identified previously taking into account information disclosures based on the TNFD recommendations announced in June 2024. We have added those nature-related risks and opportunities in the column on the right in the table below. We found that some things we see as climate-related opportunities can be nature-related risks. Conversely, we found that things we see as climate-related risks can be nature-related opportunities. In addition, we found that some climate-related risks and opportunities are also nature-related risks and opportunities. We will consider both climate-related and nature-related risks and opportunities as important management issues in the future. We will reduce the risks and maximize the opportunities for each.

Main Shimizu Group Climate-related Risks and Opportunities

| Cause | Impact on Business | Degree of Impact*1 | Timing of Impact*2 | Shimizu’s Response | Nature-related Risk and Opportunities →: Response Examples |

|||

|---|---|---|---|---|---|---|---|---|

| Transition scenarios | Risks | Stricter regulations to achieve carbon neutrality |

|

↓↓ | Medium to long-term |

|

||

| Introduction of carbon pricing |

|

↓ | Medium to long-term |

|

Opportunities | Demand for forest, agriculture, blue carbon and other CO2 credits will increase →Promote CO2 credits for the technologies we own by using our knowledge and achievements |

||

| Opportunities | Growing need for energy-saving buildings |

|

↑↑↑ | Medium-term |

|

|||

| Growing need for renewable energy |

|

↑↑↑ | Short to medium-term |

|

Risks | There will be a trade-off between renewable energy business and ecosystem protection →Incorporate techniques equivalent to environmental assessments from the planning stage and take measures to reduce impacts |

||

| Higher ratings achieved through stronger CO2 emissions reduction |

|

↑↑ | Short to medium-term |

|

Risks | Prices will increase and quantities will be restricted for biomass fuel due to rising demand for biomass (timber, waste cooking oil and food residue, etc.) → Improve environmental management capacity over the entire supply chain and strengthen partnerships |

||

| Physical scenarios | Risks | Rise in average summer temperature |

|

↓↓↓ | Medium-term |

|

Risks | Trees and plants will grow poorly and the optimal planting period will shorten |

| Increased frequency and severity of weather-related disasters |

|

↓↓ | Short to medium-term |

|

||||

| Opportunities | Stronger policies on reinforcing national resilience |

|

↑↑↑ | Short to medium-term |

|

|||

| Market changes caused by climate change |

|

↑↑↑ | Short-term |

|

||||

| Medium to long-term |

|

|||||||

| Acceleration in opening infrastructure maintenance and operation business and other public services to the private sector |

|

↑↑ | Medium-term |

|

Opportunities | Cases will emerge requiring green space management and other technologies in the PFI business → Utilize technologies and human resources which realize and differentiate natural performance*9 |

- The degree of impact : ↓↓↓ (large), ↓↓ (medium), ↓ (small) for risks and ↑↑↑ (large), ↑↑ (medium), ↑ (small) for opportunities.

- Periods of impact are short term: 3 years or less; medium term: more than 3 years and up to 10 years; long term: more than 10 years

- BSP: An abbreviation of Building Service Provider. Refers to the provision of comprehensive facility operation and management services after completion of construction.

- ZEB: An abbreviation of Zero Energy Building. Refers to a building in which the primary energy produced and used results in net zero energy use

- BEMS: An abbreviation of Building Energy Management System. Refers to a system for managing building energy.

- Sustainability renovation: Refers to the renovation of existing buildings mainly to improve environmental performance, BCP performance, and health and comfort.

- SCAT: An abbreviation of SHIMZ Carbon Assessment Tool.

- ecoBCP: Refers to facility and community development that achieves both energy efficiency and energy savings during normal operation through the implementation of ecological measures (eco) and business continuity during disasters through the implementation of measures to ensure business continuity (BCP).

- Natural performance: This is the degree to which the construction methods and measures implemented with a target set for the state of nature have a positive impact on nature. For example, the number of animal species and population actually able to move around by setting up migration routes for small animals.

Risk Management

Under “SHIMZ Beyond Zero 2050," our goal is to minimize business risks and maximize opportunities related to climate change and other aspects of the environment for the Shimizu Group. Trends in responses to climate change in Japan and the world are reported in Sustainability Committee meetings and the committee discusses climate-related risk management for the company.

This committee examined aspects of external environmental changes that will impact the Shimizu Group and revised the Environmental Management Policy which specifies the company’s basic stance on environmental management and provides guidelines for action. The committee has also established targets for the reduction in greenhouse gas (CO2) emissions as one means of managing the risk of global warming. It has decided on specific measures to achieve the targets (in the construction business, shift from fuel oil to electric power as the form of energy used at construction sites, expand the use of electric power from renewable energy sources, etc.), and is regularly monitoring emissions volume.

The Shimizu Group will address the increasingly diverse and widespread climate change-related risks through the management of these risks.

Metrics and Targets(Based on consolidated companies in Japan and overseas combined)

To evaluate and manage the impact of climate-related issues on management, the Shimizu Group is specifing total volume of greenhouse gas (CO2) emissions as an indicator (KPI) and has set medium to long term targets for reduction based on SBT* (certification acquired from the SBT Initiative in September 2019). Shimizu set the new goal of zero CO2 emissions in fiscal 2050, based on SHIMZ Beyond Zero 2050. Shimizu will obtain SBT recertification based on the new goal.

SBT: Science Based Targets

Company targets for reduction in greenhouse gas emissions that are in line with scientific knowledge and aimed at controlling the rise in average global temperature (to lower than 2℃ (or 1.5℃).

Greenhouse Gas (CO2) Reduction Targets and Performance(Consolidated companies in Japan and overseas combined)

| Scope | Base year emissions | Actual emissions | Target annual emissions | ||

|---|---|---|---|---|---|

| Fiscal 2017 | Fiscal 2023 | Fiscal 2024 | Fiscal 2030 | Fiscal 2050 | |

| Scope1※1 + Scope2※2 |

275,575 | 323,302 (17%) |

248,040 (▲10%) |

184,650 (▲33%) |

0 (▲100%) |

| (Scope1) | 216,710 | 222,346 | |||

| (Scope2) | 58,865 | 100,856 | |||

| Scope3※3 (Category11※4) |

3,451,656※6 | 2,500,248 (▲28%) |

- | 2,761,320 (▲20%) |

0 (▲100%) |

- Scope 1: Emissions from use of heavy equipment and machinery (direct emissions)

- Scope 2: Emissions from electric power and heat purchased and used (indirect emissions from electric power companies, etc.)

- Scope 3: Other indirect emissions from the supply chain

- Category 11: (From use of products sold) Volume of CO2 emissions from operation of buildings that Shimizu designed and built