- Corporate Governance Report (PDF: 713KB)last updated on June 27, 2025

- Standards on the Independence of External Officers (Outside Directors and External Audit & Supervisory Board Members)(PDF: 153KB)last updated: December 24, 2015

-

Basic Policy on Establishing a System of Internal Controls (Only in Japanese) (PDF: 223KB)

last updated on March 9, 2021 - Code of Corporate Ethics and Conduct(PDF:60.3KB)last updated on April, 2025

Basic View

Shimizu manages the company based on the principles contained in our corporate credo, The Analects and the Abacus. We strive to manage the company in a timely, highly efficient, transparent, and lawful manner to achieve sustained growth and increase corporate value over the medium and long term, while also earning a greater degree of trust from all our shareholders, investors, and all other stakeholders, including customers, employees, and local communities. We do so by fulfilling our social responsibilities through business activities.

To achieve this, we have separated the management strategy and decision-making function from the business execution function, and have established a structure that enables the Board of Directors and Audit & Supervisory Board to appropriately supervise and audit the performance of each of these functions. Our basic policy on corporate governance is for our directors, executive officers, Audit & Supervisory Board members, and employees to implement compliance management based on the highest ethical standards.

Structure

Corporate Governance Structure of Shimizu Corporation

Overview of the Corporate Governance Structure

Shimizu has adopted the institutional design of a company with an Audit & Supervisory Board. We have limited the number of directors and introduced an executive officer system to clearly separate the management strategy, decision-making, and oversight functions from the business execution function. We have established a system for supervising and overseeing management from an objective and neutral perspective by taking steps to encourage energetic debate at Board of Directors meetings, and by electing independent outside directors and outside Audit & Supervisory Board members. The concrete structure and implementation status are detailed below.

- One-third or more of the Board of Directors elected are outside directors to strengthen management supervision function, and to promote more energetic debate by the Board of Directors.

- Outside directors and other non-executive directors and outside Audit & Supervisory Board members use their extensive experience and sophisticated insight based on their individual career histories to oversee and supervise management and provide necessary advice as appropriate.

- The Company established a structure mainly consisting of the head office administrative departments to provide timely information and other materials to assist outside directors and other non-executive directors in performing their management supervisory duties (including tours of offices, job sites, etc.).

- The relevant divisions provide guidance on the Company in general, description of its businesses, and other relevant information to new outside directors and outside Audit & Supervisory Board members.

- Audit & Supervisory Board members audit all duties performed by directors from a fair and impartial perspective.

- The Audit & Supervisory Board Members Office was established as the dedicated organization to support Audit & Supervisory Board members. This office secures the necessary support staff to enable more effective audits by Audit & Supervisory Board members.

- Audit & Supervisory Board members improve the effectiveness of management supervision by attending important meetings and obtaining sufficient information from officers and employees without delay.

- When a Board of Directors meeting is held, the Board of Directors administrative office and other divisions provide explanations in advance to the outside directors, non-executive directors, and Audit & Supervisory Board members.

- Outside directors and other non-executive directors regularly exchange opinions with the chairman and president. They also exchange opinions with outside Audit & Supervisory Board members.

- Regular Outside Officers Meetings are held for outside directors and outside Audit & Supervisory Board members, and regular Outside Directors and Audit & Supervisory Board Members Meetings are held for outside directors and all Audit & Supervisory Board members to facilitate the exchange of opinions.

Main Governing Bodies Established by Shimizu (including discretionary committees and other meeting formats)

Board of Directors

The Board of Directors holds meetings once a month as a rule, and as needed. It makes decisions on matters specified in laws and regulations and the Articles of Incorporation as well as other important matters, and supervises the execution of duties. The Articles of Incorporation specifies 12 as the maximum number of directors. These directors consist of executive directors who are highly knowledgeable in each area of Shimizu’s business and non-executive directors, some of whom are outside directors with extensive expertise and experience in their respective specialties. The Chairman and Representative Director serves as the chair of the Board of Directors.

[Names and Titles of Members] (11 as of date of submission)

| Chair | Kazuyuki Inoue (Chairman of the Board and Representative Director) | |||

|---|---|---|---|---|

| Members | Internal Directors | Executive | Tatsuya Shimmura, Kentaro Ikeda, Takeshi Sekiguchi, Yoshiki Higashi | |

| Non-executive | Yoichi Miyamoto, Noriaki Shimizu | |||

| Outside Directors | Tamotsu Iwamoto, Junichi Kawada, Mayumi Tamura, Yumiko Jozuka | |||

(Main Agenda Items)

Election of directors; organizational reform; establishment, revision or repeal of company regulations; formulation and supervision of management policies and strategies; monitoring of progress and growth strategies of each business; risk management; sustainability matters such as climate change and human resources development; feedback on dialogue with investors; reduction of securities holdings; and revision of the standards for referral to the Board of Directors.

Audit & Supervisory Board

The Audit & Supervisory Board meets once a month as a rule, and additionally as necessary. It makes decisions on audit policy, audit plans, auditing methods, and other important audit matters, and deliberates on necessary matters concerning audits. The Articles of Incorporation sets the number of Audit & Supervisory Board members at a maximum of five, including three outside Audit & Supervisory Board members. The chair of the Audit & Supervisory Board is an Audit & Supervisory Board member chosen through discussion by the Audit & Supervisory Board.

[Names and Titles of Members] (five as of date of submission)

| Chair | Hideto Watanabe (standing) | |

|---|---|---|

| Members | Audit & Supervisory Board Member (standing) | Hiroshi Kobayashi |

| Audit & Supervisory Board Member (part-time) | Kaoru Ishikawa, Toshie Ikenaga, Ko Shikata (all outside Audit & Supervisory Board members) | |

Nomination & Compensation Committee

Shimizu has established a Nomination & Compensation Committee to ensure fairness and transparency in the selection, dismissal, evaluation, and compensation of directors, Audit & Supervisory Board members, and executive officers. The members of this committee consist of five non-executive directors (four outside directors and one non-executive internal director) and one executive director. The committee is chaired by a non-executive director elected every year from among the members.

[Names and Titles of Members] (six as of date of submission)

| Chair | Noriaki Shimizu (non-executive internal director) | |

|---|---|---|

| Members | Outside Directors | Tamotsu Iwamoto, Junichi Kawada, Mayumi Tamura, Yumiko Jozuka |

| Internal Director | Kazuyuki Inoue (Chairman of the Board and Representative Director) | |

(Main Agenda Items)

Creation of personnel appointments for and individual evaluations of directors and executive officers, total amount and individual bonuses for officers, individual monthly compensation for the next fiscal year, succession plans, and review of related regulations.

Risk Management Committee

Our Risk Management Committee ascertains and analyzes risks that would have a serious impact on our corporate group, which consists of Shimizu and its subsidiaries. It also determines key items of risk management, and follows up and reports to the Board of Directors. The President and Representative Director serves as the chair of the committee and one standing Audit & Supervisory Board member also attends committee meetings.

[Names and Titles of Members] (15 as of date of submission)

| Chair | Tatsuya Shimmura (President and Representative Director) | |

|---|---|---|

| Members | Kentaro Ikeda, Takeshi Sekiguchi, Yoshito Tsutsumi, Masanobu Onishi, Takao Haneda, Yoshiki Higashi, Hideo Yokoyama, Tomoaki Harada, Michiho Yamaguchi, Nobuyoshi Kikuchi, Taizo Tsukada, Deputy Manager of Digital Strategy Office, General Manager of Audit Dept., Hiroshi Kobayashi (standing Audit & Supervisory Board Member) | |

Committee on Corporate Ethics

Shimizu has established the Committee on Corporate Ethics to determine company-wide policies on strict compliance with corporate ethics, laws and regulations, and deploy and follow up on compliance. The committee is also tasked with collecting all information on serious incidents involving wrongdoing as well examining ways to prevent incidents and recurrence and issuing directions to accomplish that. The President and Representative Director serves as the chair of the committee. One full-time Audit & Supervisory Board member and one outside expert (an attorney) also attend committee meetings.

[Names and Titles of Members] (19 as of date of submission)

| Chair | Tatsuya Shimmura (President and Representative Director) | |

|---|---|---|

| Members | Kentaro Ikeda, Takeshi Sekiguchi, Yoshito Tsutsumi, Masanobu Onishi, Takao Haneda, Yoshiki Higashi, Hideo Yokoyama, Hitoshi Fujita, Michiho Yamaguchi, Nobuyoshi Kikuchi, General Manager of Legal Affairs Dept., General Manager of Human Resources Dept., General Manager of General Affairs Dept. and Manager of Corporate Ethics Help-Line Office, Manager of Group Companies Strategy Office, General Manager of Audit Dept., Senior General Manager of Business Development & Marketing Headquarters, Hideto Watanabe (standing Audit & Supervisory Board Member), outside experts (attorneys) | |

Executive Officers Council

Shimizu has established an Executive Officers Council to communicate important matters and policies decided by the Board of Directors to executive officers and provide instructions to them. The President and Representative Director serves as the chair of this council and members consist of executive directors (other than the chair) and executive officers. One full-time Audit & Supervisory Board member also attends council meetings.

Evaluating the Effectiveness of the Board of Directors

Our Board of Directors evaluates the overall effectiveness of the Board of Directors once a year.

A summary of the evaluation method and results for fiscal 2023 are provided below:

Evaluation Method

All directors and Audit & Supervisory Board members complete a survey (including anonymous entries and open answers). A self-analysis is performed through discussion by all directors and all Audit & Supervisory Board members at Board of Directors meetings, based on an analysis by a third party (attorney).

| Period covered | April 2023 to March 2024 |

|---|---|

| Dates performed | Board of Directors meetings on March 8, March 28, and April 24, 2024 *Performed ahead of schedule starting this time for disclosure ahead of Shareholders’ Meeting. |

| Main items evaluated | Board of Directors composition/operations, management strategy/management supervision function, corporate ethics/risk management, response to sustainability issues, process of determining nomination/compensation, human resources development, communication between outside directors and management, dialogue with shareholders/investors, etc. |

Summary of Evaluation Results

Conclusion: The Shimizu Board of Directors evaluated and determined the Board of Directors as a whole to be operating effectively.

Status of response to issues indicated in the last evaluation of effectiveness in FY2022 (covering April 2022 to March 2023)

The Board of Directors has made consistent efforts to resolve issues and make improvements as follows. The Board of Directors will continue to strive for further improvement.

- Further strengthen the management supervision function of the Board of Directors.

・

Expand discussions about sustainability and ESG (e.g. climate change countermeasures, human resources strategies).

→Established the Sustainability Committee (chaired by the President) whose important matters are reported to the Board of Directors to elaborate the supervision system.・

Expanded opportunities to exchange opinions about management strategies between management personnel and Outside Directors (including opportunities other than the Board of Directors Meetings) and strengthen monitoring of the progress of the Mid-Term Business Plan.

→The status of discussions on the next Mid-Term Business Plan (including the review of the current Mid-Term Business Plan) shared and discussed with Non-Executive Directors as necessary and its feedback incorporated in the plan.・

Enhance sharing of management information with Outside Directors and Outside Audit & Supervisory Board Members.

→Organized tours of offices and construction sites, attendance of the internal lectures, etc., conducted IR reports and audit reports, etc. on a regular basis. - Further promote communication with Outside Directors, Outside Audit & Supervisory Board Members, and management personnel (ongoing).

→

Set up various meetings, etc. and organize them regularly. Held meetings to exchange opinions between all Inside Directors and Non-Executive Directors.

Major issues identified in the effectiveness evaluation.

- Monitoring and supervision of the progress of the Mid-Term Business Plan by the Board of Directors

・

Strengthen monitoring of how the Mid-Term Business Plan and the annual Operation Plan are linked, how it is adopted across the Company and its progress.

- The Board of Directors to check that management resources are appropriately distributed

・

Further discussions on business portfolio taking into account medium to long term growth.

- Sharing the deliberation status, etc. of the Nomination and Compensation Committee at the Board of Directors

・

The Board of Directors to check the deliberation process of the Nomination and Compensation Committee in addition to its result.

- Expanded disclosure of non-financial information

・

Expanded information disclosure related to risk management and sustainability.

Future initiatives

Based on the results of the evaluation of the effectiveness of the Board of Directors, the Company aims to enhance the effectiveness of the Board of Directors and further expand and reinforce corporate governance through the PDCA cycle to improve on issues.

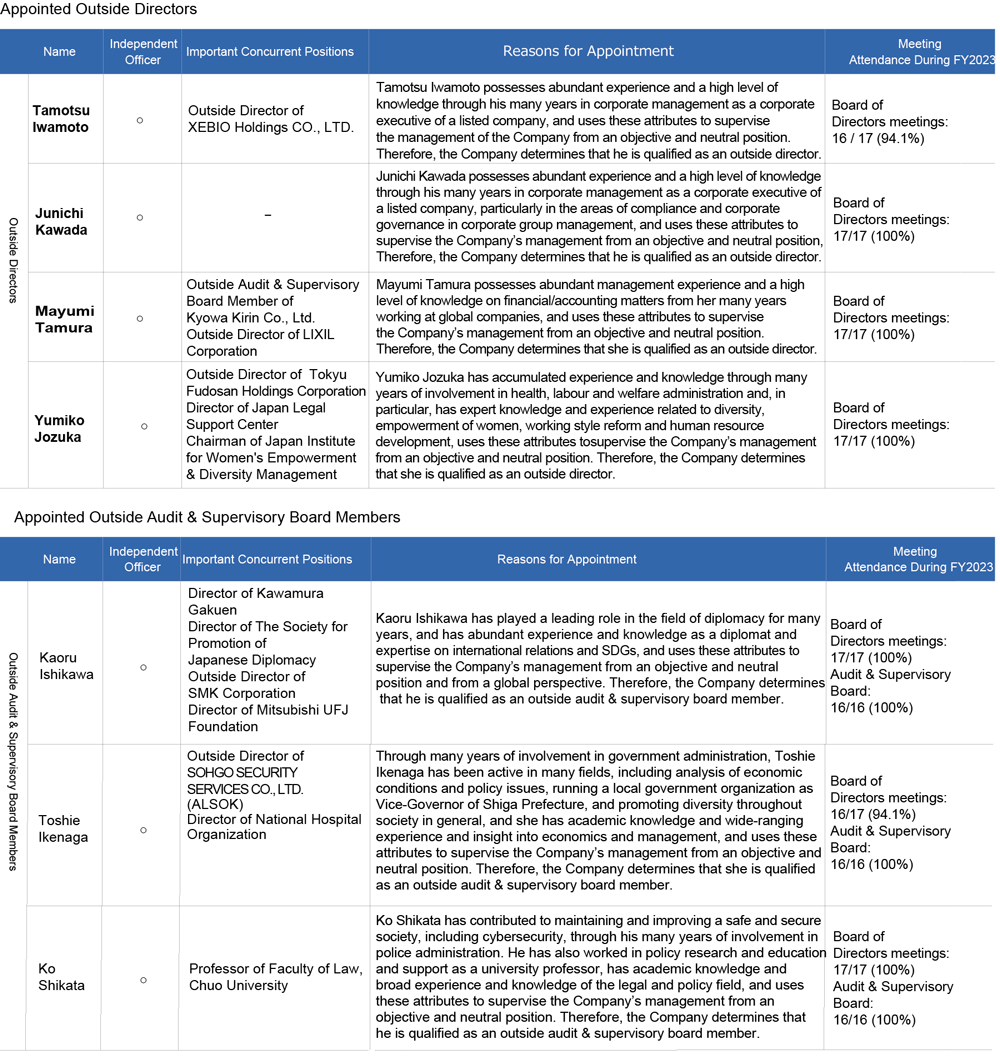

Election of Outside Directors and Outside Audit & Supervisory Board Members

as of June 27, 2024

Standards regarding the Independence of Outside Officers (outside directors and outside auditors)

Support Structure for Outside Officers (outside directors and outside Audit & Supervisory Board members)

Shimizu has established a system to provide information to facilitate supervision of management by outside directors and other non-executive directors in performing their duties. The administration departments in the head office play the main role in providing this information in a timely manner. The Corporate Auditor’s Office was established as a dedicated organization to support Audit & Supervisory Board members. A sufficient number of staff members have been secured to assist outside Audit & Supervisory Board members. When a Board of Directors meeting is held, materials are distributed in advance and the Board of Directors administrative office and other divisions provide explanations in advance to the outside directors and the outside Audit & Supervisory Board members.

Directors, Audit & Supervisory Board Members, and Executive Officers

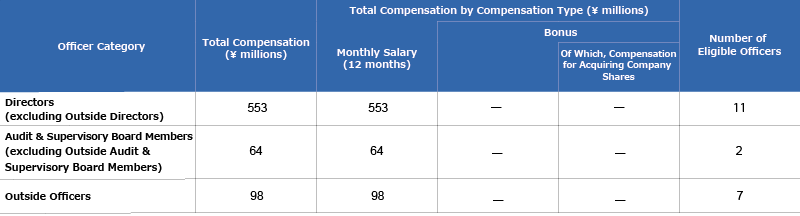

Officer Compensation

Policy on Determining Officer Compensation

Director and executive officer compensation consists of a base salary which is paid monthly and performance-linked bonuses. Shimizu has established a Nomination & Compensation Committee, which consists of a majority of outside directors and is chaired by a non-executive director, to ensure fair and transparent evaluation and compensation of directors and officers through deliberation by the committee based on the resolution of the Board of Directors.

Non-executive directors, including outside directors, and Audit & Supervisory Board members are only paid a monthly salary to enhance the management supervisory function.

Rules on the Compensation of Officers specifying the policy on determining the compensation of each director were approved at the Board of Directors meeting held on February 24, 2021. A summary description of the policy on determination is provided below.

Policy on Basic Compensation

A maximum total of 90 million yen a month in director compensation as base monthly salary was established at the 117th Annual General Meeting of Shareholders held on June 27, 2019. Compensation of outside directors is capped at 10 million yen of the amount noted above.

A maximum total limit of 13 million yen a month in Audit & Supervisory Board member compensation was established at the 89th Annual General Meeting of Shareholders held on June 27, 1991 and the compensation is determined through discussion by the Audit & Supervisory Board.

Policy on Performance-linked Compensation

Out of the compensation paid to directors of the Company, bonuses, which are performance-linked compensation, are limited to an annual amount of 500 million yen based on the resolution of the 118th Annual General Meeting of Shareholders held on June 26, 2020. The Nomination & Compensation Committee deliberates and determines whether or not to pay such bonuses and the amount to be paid.

To encourage the further sharing of values with shareholders and increase corporate value over the medium to long term, an amount corresponding to 20% of the bonus as performance-linked compensation, shall be deemed to be compensation for purchasing the Company’s shares, and each Director shall contribute this remuneration to the Executives’ Shareholding Association, which shall acquire the Company’s shares. The Company’s shares that are acquired in this way shall continue to be held for the duration of the Director’s tenure and for a fixed period of time after resignation.

(Method of calculating individual performance-linked compensation [bonuses])

Consolidated performance*1 x performance coefficient*2 x rank index*3 x individual evaluation coefficient*4 = Individual bonus*5

- *1. Consolidated net income (net income attributable to shareholders of the Corporation)

- *2. The Nomination & Compensation Committee determines the performance coefficient, considering the degree of achievement compared to the initial forecast for consolidated operating income and consolidated net income, as well as factors such as orders received, financial KPIs from the Mid-Term Business Plan, the status of achievement of non-financial KPIs, and the performance outlook for the following fiscal year.

・Financial KPIs (ROE, ratio of Owners' equity attributable to shareholders of the Corporation, debt to equity ratio, and dividend payout ratio)

・Non-financial KPIs (productivity improvement rate in construction business, CO2 reduction rate in construction business, employee satisfaction scores, and number of serious legal violations) - *3. Coefficient set by rank

- *4. Executive directors set targets for each officer after interviewing them at the beginning and end of the fiscal year and evaluate their performance by the degree of achievement, and the individual evaluation coefficient is determined after the Nomination & Compensation Committee reviews the evaluation. (Evaluation coefficient is set between 65% and 135%)

In addition to short-term performance evaluations set for each individual, we perform multifaceted evaluations that include the degree of contribution to achieving the targets of the Mid-Term Business Plan, efforts to strengthen the management foundation, contributions to the SDGs, and evaluations from a human resources perspective.

Director evaluations are determined only by the non-executive directors on the Nomination & Compensation Committee. - *5. An amount equivalent to 20% of the performance-linked bonus is granted as compensation for acquiring Shimizu shares to give directors greater shared value with shareholders and to enhance corporate value over the medium and long term. The share-based compensation for each director is contributed to the officers’ stock ownership plan and is used to acquire Shimizu shares. Directors must also hold the shares acquired while employed by Shimizu and for a certain period of time after leaving the company.

Matters concerning delegation of decisions on compensation, etc.

Shimizu has established a Nomination & Compensation Committee which consists of a majority of outside directors and is chaired by a non-executive director, to ensure fair and transparent evaluation and compensation of directors and officers through deliberation by the committee based on the resolution of the Board of Directors.

The Nomination & Compensation Committee reviewed compensation for last fiscal year ended March 31, 2024 and discussed the base monthly salary and the amount to be paid as bonuses for each director according to the evaluation of the performance of each director, based on the Rules on Officer Compensation. The committee determined the compensation to be in line with policy determined by the Board of Directors.

Director and Audit & Supervisory Board Member Compensation

FY2023

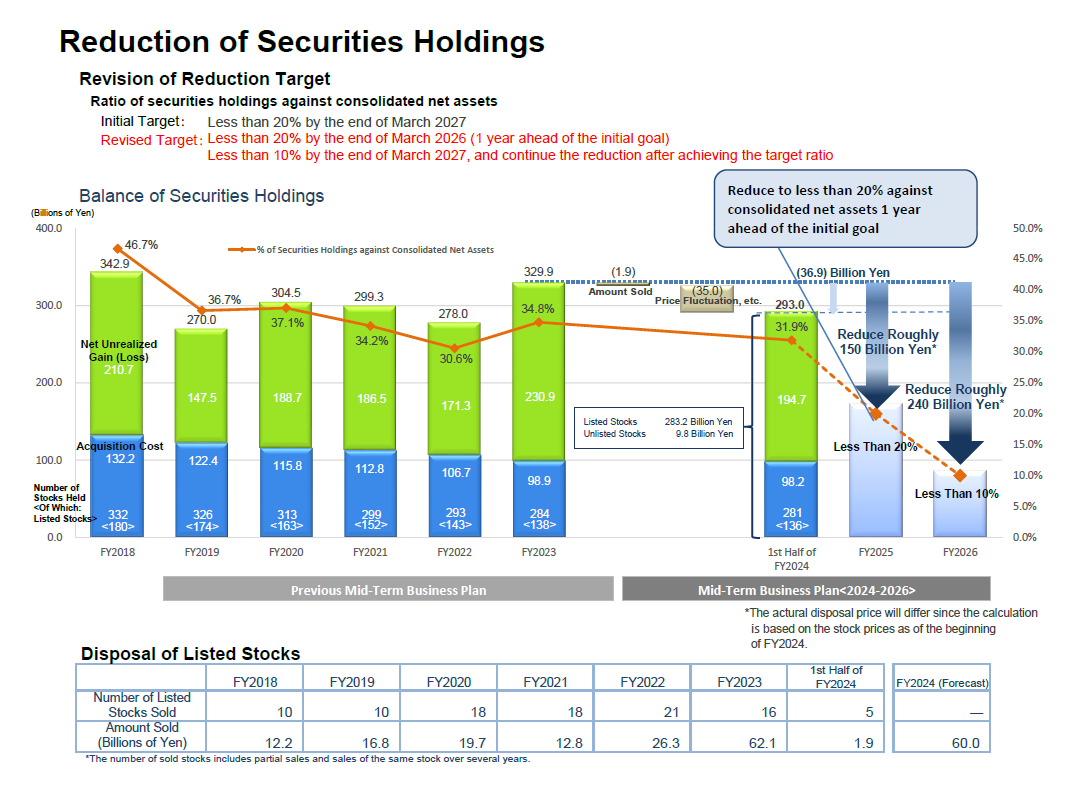

Securities Holdings

Policy on Securities Holdings

When there is a necessity from the viewpoint of business development, the Company acquires and retains shares of clients and business partners to strengthen and maintain relationships. Acquisition of major securities is determined by the Board of Directors, taking comprehensive consideration of benefits to the Company, acquisition cost, risk of share price changes and other factors. The Board of Directors examines the necessity of securities holdings for individual stocks each year, taking into consideration its economic rationality, including cost, risk, and sales benefits. Regarding the shares which don’t give much sales benefits any more according to the examination, we are reducing securities holdings in stages through confirming relationships with business partners to promote the effective utilization of capital.

Status of Reduction of Securities Holdings

To effectively use our capital, the Company established a following goal: “to reduce the ratio of the outstanding amount of securities holdings to consolidated net assets to less than 20% by the end of March 2027”, and announced it to the public on April 26, 2023. Since then, we have been seeking to reduce the volume of securities holdings. At the Board of Directors Meeting held on November 12, 2024, we have decided to move up the target date of the existing reduction goal by one year to the end of March 2026, so that we can accelerate the implementation of “management that is conscious of cost of capital and stock price”. We have also established a new goal of reducing the ratio of the outstanding amount of securities holdings to consolidated net assets to less than 10% by the end of March 2027”.

The Company sold shares of 31 listed companies during fiscal 2024 (including shares of which part of the holdings were sold). The proceeds were ¥58.6 billion. From fiscal 2018 to fiscal 2024, the total number of listed companies of which the Company sold its holdings was 91 (including shares of which part of the holdings were sold). The proceeds were ¥208.6 billion.

As a result, the number of listed companies the Company held shares in decreased from 187 as of the end of March 2018 to 123 as of the end of March 2024.

As of the end of March 2024, the proportion of securities holdings in consolidated net assets is 27.0%.

Criteria for exercising voting rights pertaining to securities holdings

The Company exercises voting rights on securities holdings after comprehensively examining the contents of proposals, referring to the Policy on securities holdings above, and judging whether to vote for or against each proposal from the perspective of whether the corporate value of the Company and business partners may increase.

Policy in case the cross-shareholder has expressed their intention to sell the shares

In case the cross-shareholder has expressed their intention to sell the Company’s shares, we will not act to prevent the sale by, for example, suggesting that we will reduce transactions with the company concerned.

Internal Control System Establishment

We have established a Basic Policy on Establishing a System of Internal Controls based on the Companies Act.

Basic Policy on Establishing a System of Internal Controls (Only in Japanese) (PDF: 223 KB)

Last revision: March 9, 2021

Internal Control System Status

Shimizu has established a system of internal controls and the Board of Directors makes decisions on the Basic Policy on Establishing a System of Internal Controls to ensure proper operation of the company.

An overview of the operational status of internal control systems in fiscal 2024 is provided below.

| Compliance System |

|

|---|---|

| Risk Management System |

|

| Systems to Ensure Proper Operation of the Shimizu Group |

|

| System for Ensuring Effectiveness of Audits by Auditors |

|

Risk Management

Compliance

Code of Corporate Ethics and Conduct and Internal Corporate Structure

Code of Corporate Ethics and Conduct

Shimizu has adopted The Analects and the Abacus, which contains the teachings of Eiichi Shibusawa, as our corporate credo. We base our business activities on the conviction that our company’s business will always prosper if we pursue ethics and economic gain simultaneously, or in other words, if we do good work that delights the community and our customers and is grounded in a strong sense of ethics. In this era of strong demand for corporate social responsibility, we have established the Code of Corporate Ethics and Conduct to ensure that all officers and employees thoroughly understand The Analects and the Abacus and demonstrate it in their daily actions. We are committed to enforcing corporate ethics, including compliance with laws and regulations.

Establishment of Internal Corporate Structure

Shimizu provides education and training to ensure strict implementation and practical operation of the Code of Corporate Ethics and Conduct by officers and employees. We have also appointed an officer in charge of corporate ethics, established a Committee on Corporate Ethics, the Corporate Ethics Office, the Corporate Ethics Help-Line Office, and an internal whistleblowing system.

Proper Management of Personal Information

In addition to establishing the Privacy Policy, we have appointed a Corporate Personal Information Protection Administrator to promote appropriate measures for the proper management of personal information, including individual numbers (the “My Number” system).

Internal Whistleblowing System

The Shimizu Group has established an internal whistleblowing system allowing officers and employees of Shimizu, subsidiaries, and subcontractors to consult about or report various compliance issues that may arise within the Group, anonymously or otherwise. This encompasses actions by officers and employees of the Group that may violate the Code of Corporate Ethics and Conduct (such as harassment and other human rights violations, accounting fraud, bribery, and other corrupt practices).

Under this system, a Corporate Ethics Help-line Office, a Harassment Consultation Desk, and an External Consultation Desk staffed by outside attorneys have been established as Consultation and Reporting Desks (Compliance Hotlines). Reports submitted to these desks are thoroughly investigated, and appropriate measures are taken as needed. We ensure that whistleblowers are not subjected to any adverse treatment.

Stakeholders outside of the Shimizu Group may consult with us via the contact information on our website.

Internal Whistleblowing System Diagram

Initiatives Aimed at Strengthening Compliance

We implement various measures that will help cultivate an ethical mindset and contribute to strict compliance among Group officers and employees, so that they put the spirit of our corporate credo, The Analects and the Abacus, into practice in their actions.

Top management will lead by example in cultivating an ethical mindset and strict compliance.

- Corporate ethics training for executive management (including management of Group companies)

- Compliance e-learning training (including Compliance with the Anti- monopoly Act)

Make sure that everyone understands the code of conduct on bidding for construction projects (mainly for Shimizu and construction-related subsidiaries)

We conduct training and interviews for officers and employees to ensure thorough awareness of the code of conduct as well as interviews by outside attorneys and other experts as necessary on a case-by-case basis.