Analysis of Operating Performance and Financial Position

Summary of Business Results for FY2023

In FY2023, the Japanese economy showed a moderate recovery due to the normalization of social and economic activities and the resumption of inbound demand. On the other hand, the global high prices of commodities and monetary tightening in various countries, as well as the prolonged crisis in Ukraine and other instability in the international situation, had a broad impact on business activities and people's lives.

In the construction industry, public investment remained firm and private capital investment showed signs of picking up. On the supply side, however, the business environment remained challenging due to the impact of high prices for construction materials and energy and rising labor costs.

Under these circumstances, the Group's net sales increased 3.7% from the previous fiscal year to 2,005.5 billion yen due to an increase in completed construction contracts and development business and other sales.

As for profits, operating income was a loss of 24.6 billion yen (a gain of 54.6 billion yen in the previous year) and ordinary income was a loss of 19.8 billion yen (a gain of 56.5 billion yen in the previous year), mainly due to a decrease in gross profit on completed construction contracts as a result of the provision for loss on construction contracts due to a significant deterioration in profitability of several large-scale construction projects in Japan and overseas. Net income attributable to shareholders of the parent company decreased 65.0% from the previous period to 17.1 billion yen due to the recording of extraordinary gains, including a gain on sales of fixed assets resulting from the sale of stock holdings.

Forecast for FY2024

In FY2024, the Japanese economy is expected to continue its gradual recovery due to an improved employment and income environment and a continued pickup in capital investment. However, the Japanese economy may be affected by continued instability in the international situation, in addition to concerns about a slowdown in the global economy due to monetary tightening in various countries.

In the construction industry, public investment is expected to remain firm and private investment is expected to continue to pick up in capital investment. On the supply side, however, there are concerns such as high prices of construction materials and energy, rising labor costs, tightening of labor regulations, and the ongoing shortage of workers, so we must continue to closely monitor trends. In addition, there are concerns about the tightening of labor regulations and the ongoing shortage of workers.

In this business environment, we expect consolidated net sales of 1,800 billion yen (down 10.2% year-on-year), operating income of 41 billion yen (a loss of 24.6 billion yen in the previous year), ordinary income of 41 billion yen (a loss of 19.8 billion yen in the previous year), and net income attributable to owners of the parent of 40 billion yen (up 133.0% year-on-year) for the fiscal year 2024.

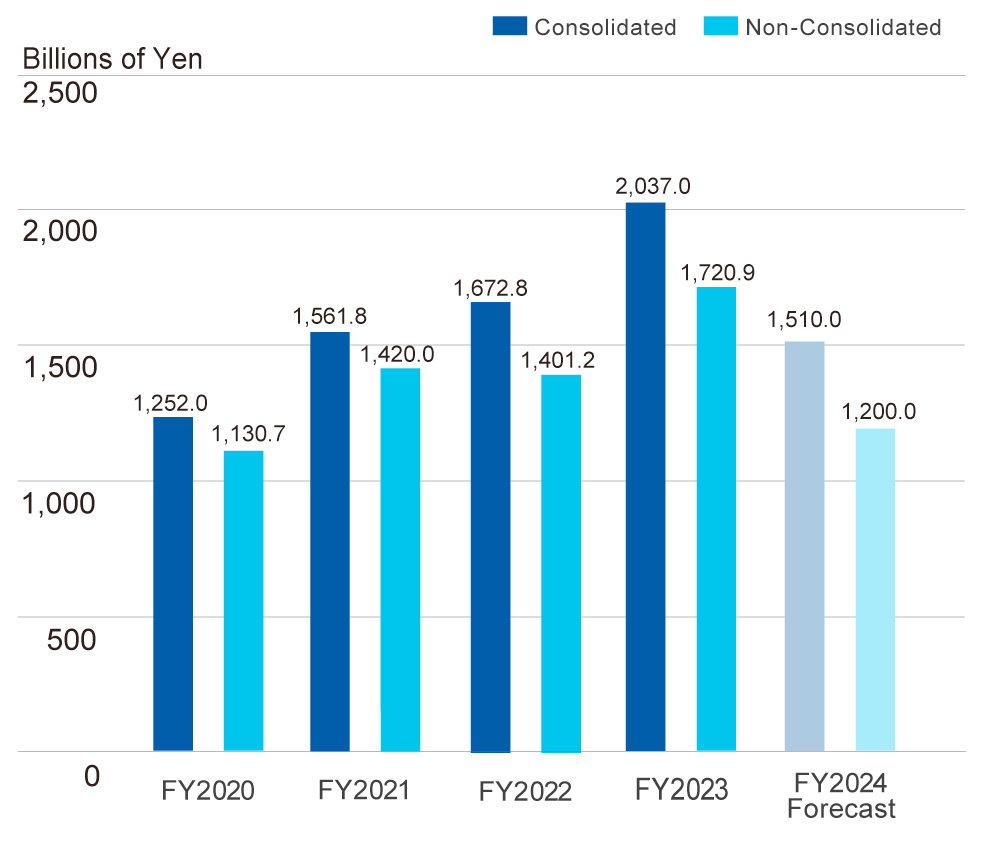

Construction Business Orders

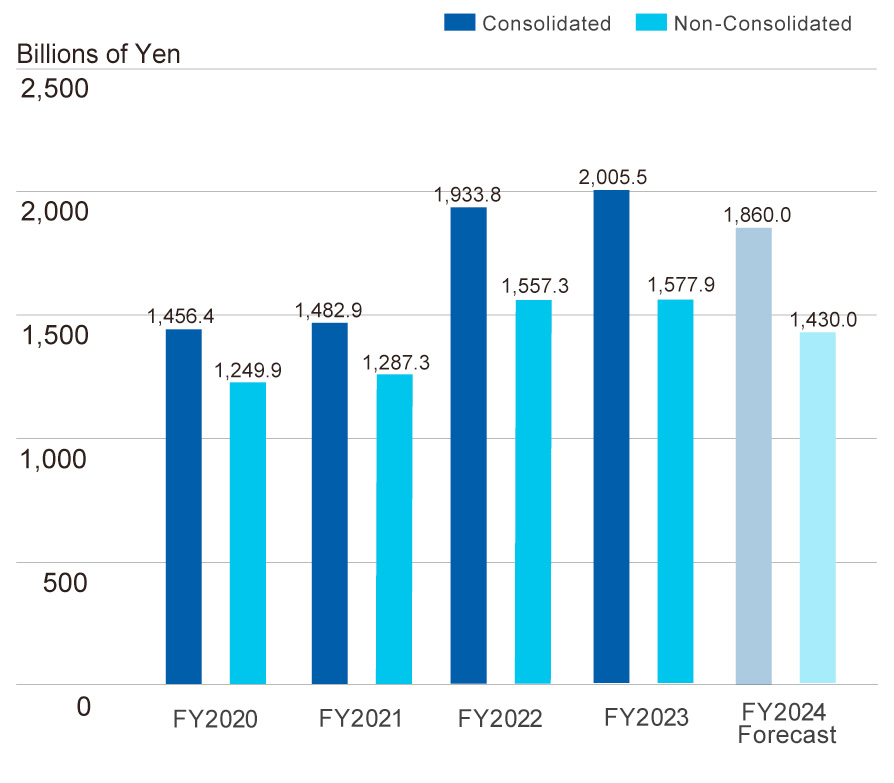

Net Sales

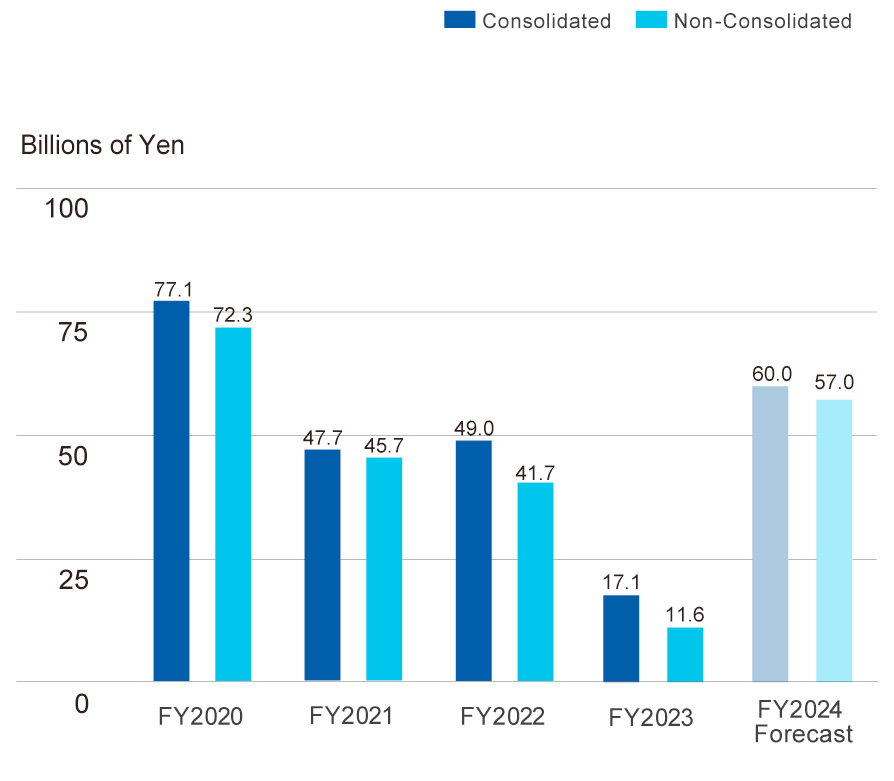

Net Income Attributable to Shareholders of the Corporation

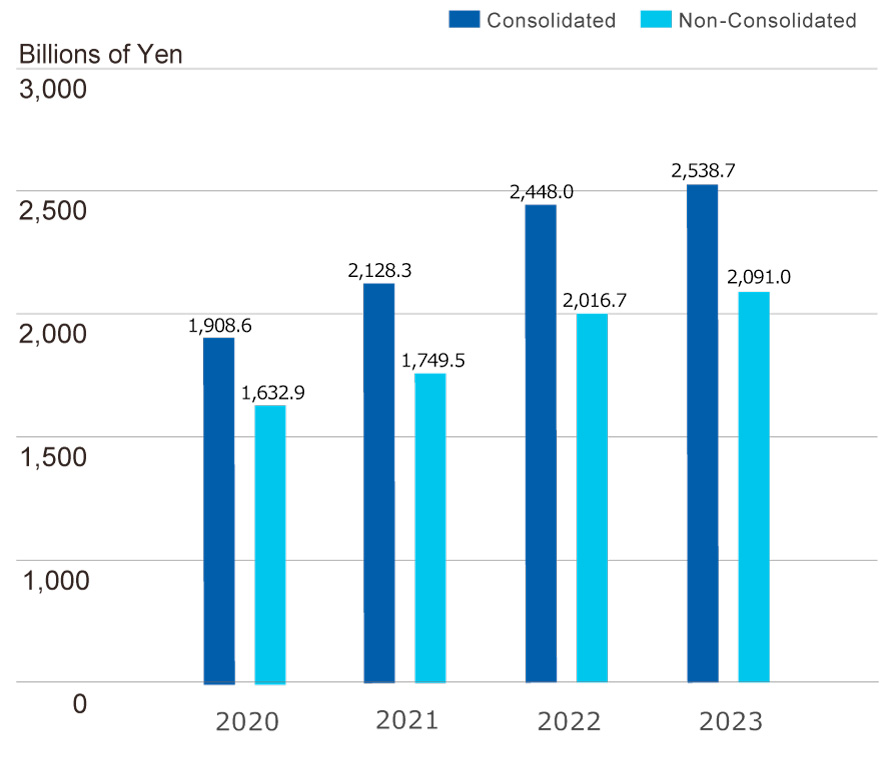

Total Assets

Net Assets

Interest-bearing Debt

(Billions of Yen)

| FY 2020 | FY 2021 | FY 2022 | FY 2023 | FY 2024 Forecast |

||

|---|---|---|---|---|---|---|

| Construction Business Orders | Consolidated | 1,252.0 | 1,561.8 | 1,6728.0 | 2,037.0 | 1,230.0 |

| Non-Consolidated | 1,130.7 | 1,420.0 | 1,401.2 | 1,720.9 | 950.0 | |

| Net Sales | Consolidated | 1,456.4 | 1,482.9 | 1,933.8 | 2,005.5 | 1,800.0 |

| Non-Consolidated | 1,249.9 | 1,287.3 | 1,557.3 | 1,577.9 | 1,380.0 | |

| Net Income Attributable to Shareholders of the Corporation | Consolidated | 77.1 | 47.7 | 49.0 | 17.1 | 40.0 |

| Non-Consolidated | 72.3 | 45.7 | 41.7 | 11.6 | 35.0 | |

| Total Assets | Consolidated | 1,908.6 | 2,128.3 | 2,448.0 | 2,538.7 | - |

| Non-Consolidated | 1,632.9 | 1,749.5 | 2,016.7 | 2,091.0 | - | |

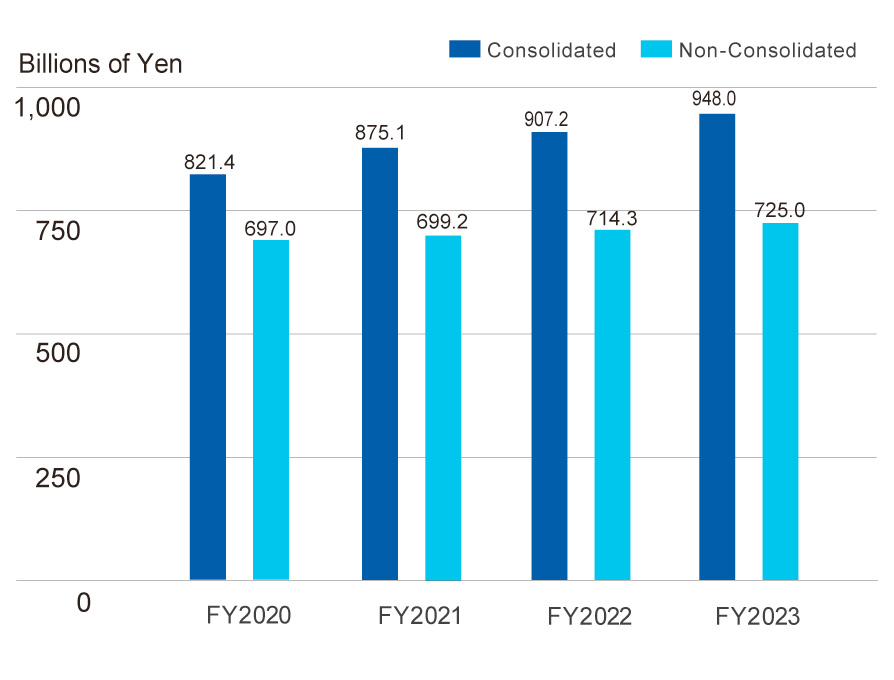

| Net Assets | Consolidated | 821.4 | 875.1 | 907.2 | 948.0 | - |

| Non-Consolidated | 697.0 | 699.2 | 714.3 | 725.0 | - | |

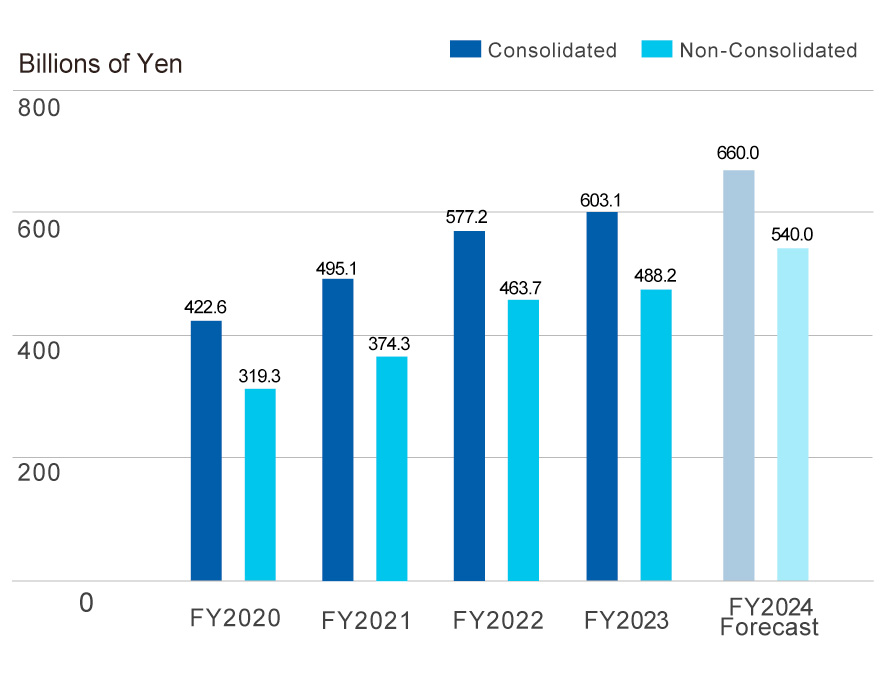

| Interest-bearing Debt | Consolidated | 422.6 | 495.1 | 577.2 | 603.1 | 660.0 |

| Non-Consolidated | 319.3 | 374.3 | 463.7 | 488.2 | 540.0 |