Our group views nature-related impacts as a critical management issue, just as we do climate change. After endorsing the TNFD recommendations in February 2023, the Company has announced early adoption. as a

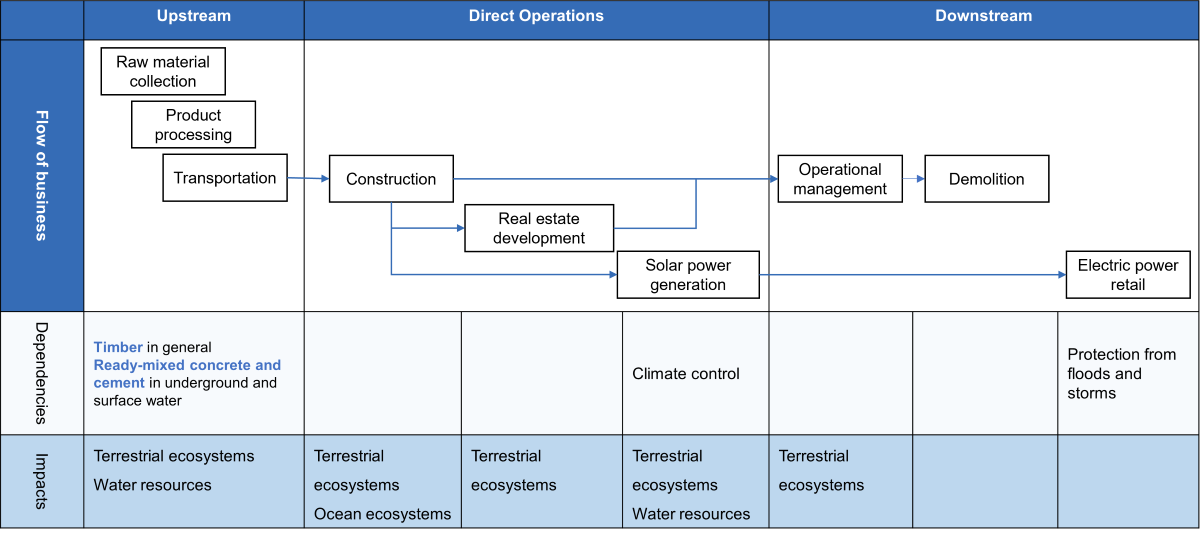

TNFD Early Adopter in January 2024. In FY2025, as in the previous year, we selected five business areas—construction (building construction and civil engineering), real estate development, green energy development (solar power), and engineering (offshore wind power)—based on their potential financial impact on our operations.

This page is an overview of our disclosures. You can download the full text as a PDF. The full text

also contains comments from experts about future issues relating to the disclosure contents.

TNFD Recommendations: Thematic Areas of Nature-related Information Disclosures

| General Requirements | General requirements relating to disclosures |

|---|---|

| Governance | The organization’s governance around nature-related risks and opportunities |

| Strategy | Identification of dependencies and impacts in

business, materiality issues, and our response Analysis of risks and opportunities with scenario analysis and assessment of the degree of impact Strategy to Address Nature-related Issues Identification of priority locations |

| Risk and Impact Management | Methods used by the organization to identify, manage and assess nature-related risks |

| Metrics and Targets | Disclosure of the global core metrics in the TNFD recommendations |

General Requirements Relating to Disclosures

| 1.The Application of Materiality | Concept focusing two impacts: financial impact on our company and the impact of our activities on nature |

|---|---|

| 2.The Scope of Disclosures | Our FY2025 disclosure covers upstream, direct operations, and downstream activities across the five domestic business areas noted above. |

| 3.The Location of Nature-Related Issues | Construction (building construction and civil engineering): Construction sites Real estate development business: Facilities we own Offshore wind power: currently operating construction sites |

| 4.Integration with Other Sustainability-Related Disclosures | Conduct TNFD scenario analysis jointly with TCFD scenario analysis members to understand the mutual impacts and then state them in their respective disclosure documents |

| 5.The Time Horizons Considered | Short-term: 3 years or less / medium-term: 10 years of less / long-term: over 10 years |

| 6.Stakeholder Engagement | Engage in business activities while emphasizing engagement with regional communities in accordance with the Shimizu Group Basic Human Rights Policy(Only in Japanese) and Code of Corporate Ethics and Conduct |

Governance

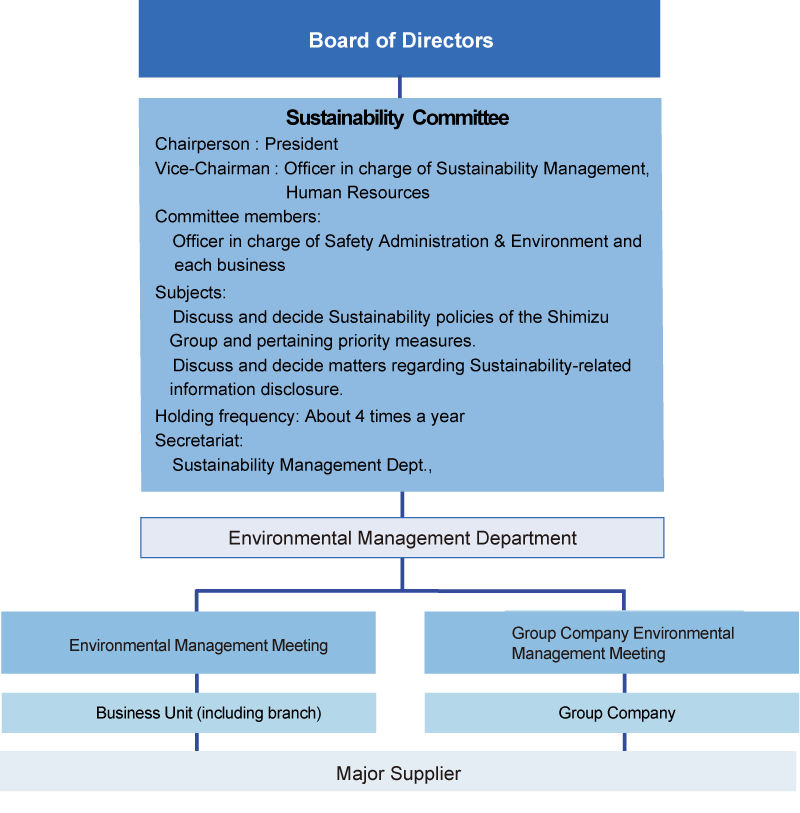

We have built a governance structure centered on the Sustainability Committee (Chairperson: President) in

the same way as with climate-related issues.

Furthermore, the Group has established the Shimizu Basic Human Rights Policy. We have also established

an external whistleblowing hotline for subcontractors.

To minimize nature-related risks and support conservation and restoration efforts, we engage with local communities located near construction sites and business locations.

Shimizu Group Governance Structure for Environmental-related Issues

Strategy

(1)Identification of Dependencies and Impacts on Nature(Ecosystem Service)

We used the revised edition of ENCORE nature-related risk analysis tool recommended in the TNFD recommendations to grasp the relationship between our businesses and natural capital. In our analysis, these five business areas were again selected for FY2025 due to their relevance to assessing potential financial impacts on the company.

Summary of the Dependencies and Impacts on Nature (Ecosystem Service) in the Three Businesses

(2)Identification of Important Issues in Businesses

Identification of Important Issues in the Upstream

For upstream operations, we identified priority issues by organizing procurement volumes and raw materials in combination with the results of dependency and impact analyses. These findings are summarized in the table below, “Response to Priority Procurement Items.”

We identified concrete formwork plywood as a key upstream issue and are advancing related initiatives. For major procurement items, we conduct supplier surveys to confirm the use of raw materials listed in the High Impact Commodity List.

Value Chain Initiatives (Upstream)

Response to Procurement Items with a High Degree of Priority

| Item | Manufacturer and Raw Materials Flow | Size of the Supplier | Our Response |

|---|---|---|---|

| Steel Material | ・Steel Manufacturers ・Raw materials are imported or recycled |

Large company | Encourage with CSR procurement questionnaires and cooperate where necessary |

| Cement | ・Cement Manufacturer ・Lime is domestically produced |

||

| Glass | ・Glass Manufacturers ・Raw materials are domestically produced or imported |

||

| Aluminum | ・Manufacturer (sash etc.) ・Raw materials are imported or recycled |

||

| Ready-mixed concrete | ・Ready-mixed concrete factory near the

construction site ・Gravel and sand are collected domestically ・Using wood for formwork |

Regional SMEs | Collaborate for improvements by supplying technologies and information |

Identification of Important Issues in Direct Operations

For direct operations, we recognize the key issue that land-use changes influence both terrestrial and marine ecosystems. For all current construction sites and upcoming planned projects, we assess natural conditions and potential nature-related risks comprehensively and implement measures to avoid or reduce impacts on the natural environment.

Value Chain Initiatives (Direct Operations)

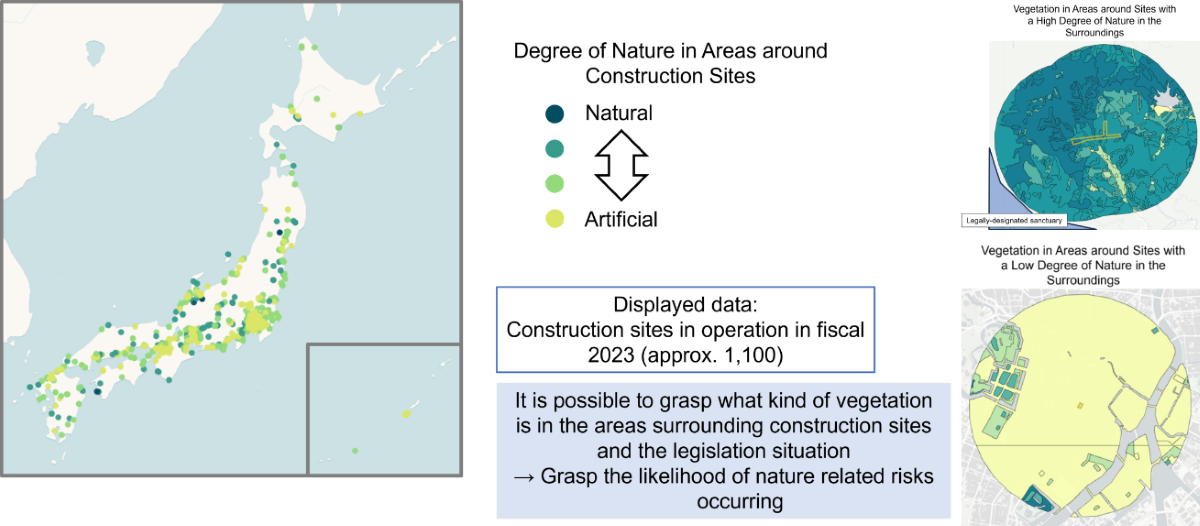

Identification of Priority Areas

Identification of Important Issues in the Downstream

Downstream, the key issue involves construction by-products. We continue to strengthen legal compliance while reducing the generation of construction by-products and promoting further recycling.

Value Chain Initiatives (Downstream)

(3)Identification of Risks and Opportunities Based on Scenario Analysis

In addition to the TCFD working members, employees, including those in finance as well as in upstream (procurement) to downstream (by-product management) departments, conducted scenario analysis using the four quadrant scenarios in the TNFD recommendations.

Beyond scenario analysis, we also assess nature-related risks and opportunities through supplier engagement and internal capacity building. This includes conducting questionnaires with major construction-material suppliers and holding internal workshops based on the IPBES Nexus Assessment Report.

Scenario Analysis Results (Selection of the Scenarios with the Greatest Degree of Impact on Our Businesses)

| Business scope | Matter | R:Risks O:Opportunities |

Degree of Impact | Timing | Shimizu’s Response | |

|---|---|---|---|---|---|---|

| Upstream | Demand for traceability and environmental | R | Competition resulting from market consolidation, price increases, and quantity limitations | ↓↓ | Short to medium-term |

|

| O | Securing an advantage through new technology | ↑↑↑ | Short to medium-term |

|

||

| Difficulty and instability in obtaining construction materials (disasters and resource depletion) | R | Unclear and unstable material prices and construction delays | ↓↓ | medium to long-term |

|

|

| O | Rebuilding and strengthening the supply chain and securing an advantage through new technology | ↑↑↑ | medium to long-term |

|

||

| Direct operations | Tight restrictions on land modification and a fundamental review of land use | R | Decrease in new construction demand | ↓↓↓ | Long-term |

|

| O | Increase in renovation and renewal work and implementation of nature-friendly and reclamation projects | ↑↑ | Long-term |

|

||

| Tighter nature-related regulations and monitoring at construction sites | R | Reputational risk and brand damage | ↓↓ | Short to long-term |

|

|

| Downstream | Demand for evaluation and monitoring of natural performance*5 | R | Prolonged construction responsibility, increase in post-construction work, and increase in management workload | ↓↓ | Short to medium-term |

|

| O | Technology that realizes natural performance*5 for differentiation | ↑↑ | Short to medium-term |

|

||

| Strong demand for recycling, including regulation of total emission | R | Tight restrictions from design stage | ↓↓↓ | Long-term |

|

|

| O | Demolition technology directly ties into construction skills | ↑↑↑ | Long-term |

|

||

- Our self-propelled SEP vessel with one of the world’s largest loading and crane capacities

- A building operating system equipped with a building operation digitalization platform function for easily linking and controlling equipment and IoT devices inside the building with various applications

- A hydrogen energy utilization system for buildings that electrolyzes water using surplus renewable energy, stores the generated hydrogen in a storage alloy, and then extracts it as needed to generate electricity

- A business concept where the blessings of nature are returned to the whole region by developing infrastructure while making wise use of the functions of nature and adding the software and technology of the Shimizu Group

- This is the ability to show how effective selected construction methods and measures are for targets when targets have been set for the state of nature and construction methods and measures have been taken to achieve them. For example, this is the ability of small animals to actually be able to move by setting up migration routes for them and the ability to achieve a lower impact than existing construction methods by selecting a construction method which reduces the impact on bird roosts.

- A system that enables efficient and integrated management of construction by-products, including forecasts of the amount of by-products generated by type, presentation of reduction options, issuance of electronic manifests, and management of company-wide by-product emissions

(4)Shimizu Corporation’s Strategy to Be Nature-related Positive

Toward Nature Transition Plans

At the 2024 Conference of the Parties (COP16), the TNFD released a discussion paper on Nature Transition Plans. We are preparing to integrate our ongoing initiatives and disclose them together with the supporting evidence required under this framework.

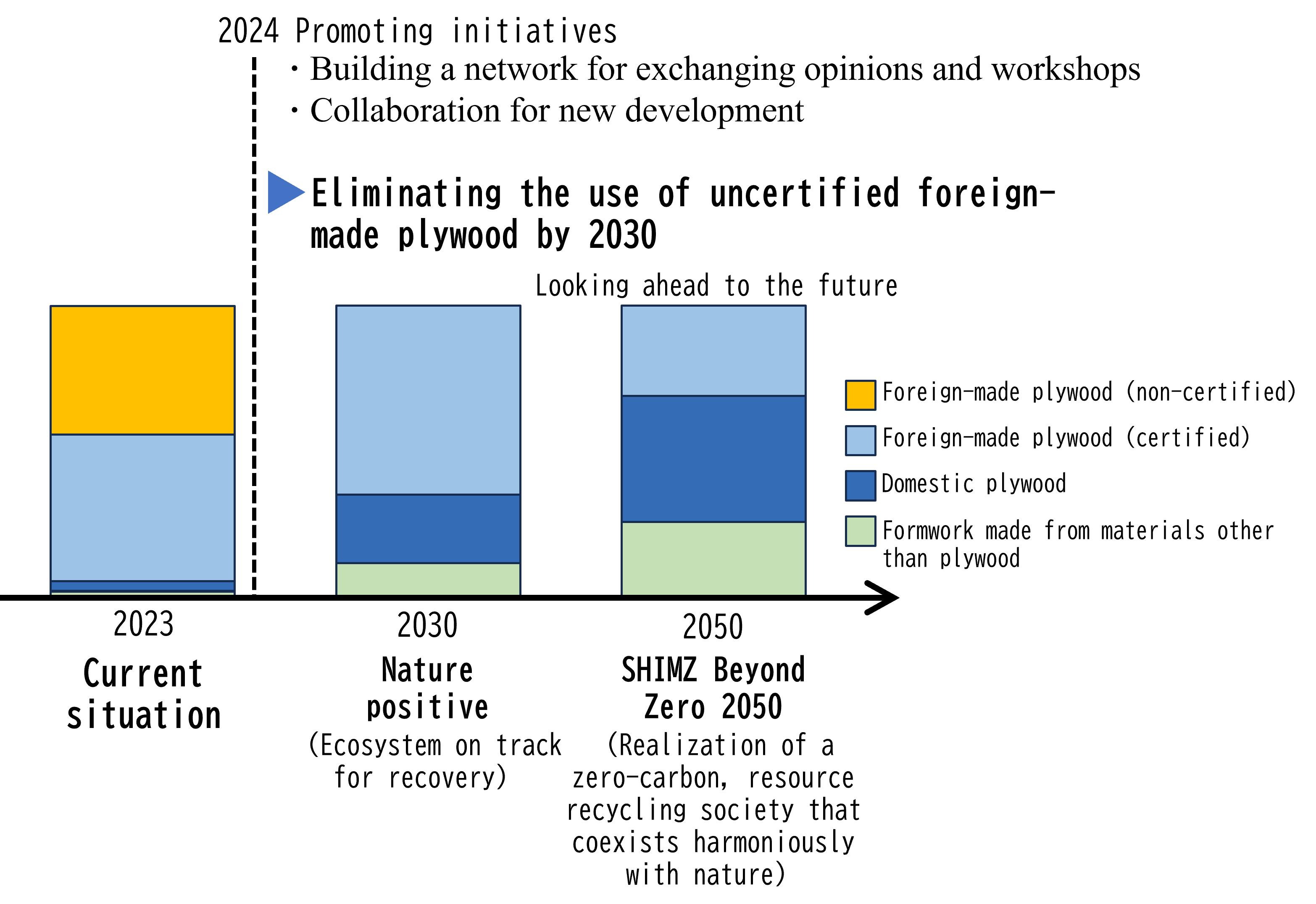

Value Chain Initiatives (Upstream)

In the upstream value chain, we are focusing on concrete formwork plywood. Working together with manufacturers, partner companies, and other stakeholders, we are advancing efforts to achieve our goal of eliminating the use of non-certified foreign plywood at all Shimizu construction sites by 2030.

Value Chain Initiatives (Direct Operations)

In our direct operations, we highlight the use of 「Environmental KY®」 to assess naturalness levels around construction sites, initiatives based on the mitigation hierarchy, nature-positive case examples such as habitat support for house swifts at construction sites, activities at overseas construction sites, and the use of UE-Net, our urban ecosystem network evaluation system.

Value Chain Initiatives (Downstream)

Downstream in the value chain, we advance initiatives to recycle construction by-products. These include recycling waste flat glass from demolition sites with AGC Inc., upcycling waste materials at our Onko-soshin no Mori NOVARE facility, recycling used paper cups from construction sites with Oji Holdings Corporation, material recycling of waste plastics, and initiatives to recycle used uniforms.

Regional Initiatives

Regional initiatives include the ongoing restoration of wetland green infrastructure at Yatsuhori no Shimizu Yatsu in Tomisato City, Chiba Prefecture (a Nature Coexistence Site); broad collaborations making use of our facilities in Koto City, Tokyo (Institute of Technology, NOVARE, and Mokkoujou Arts & Crafts Furnishings); and the sustainable timber-use project Shimizu Meguri no Mori.

Developing Future Leaders

To address nature-related challenges, we believe it is essential to consider not only our business value chain and the regions surrounding our operations, but also a long-term perspective.

Initiatives include holding discussions to raise employee awareness as part of efforts to achieve the Group Environmental Vision SHIMZ Beyond Zero 2050, nature-experience training for new employees in collaboration with the Gifu Academy of Forest Science and Culture, the Secret Base Project where construction-division employees developed plans and secured materials to bring children’s ideas to life, and the Shimizu Open Academy, a free lecture and facility-tour program offered at the Institute of Technology for students from Japan and abroad.

(5)Identification of Priority Locations

For the current year, priority areas were identified based on 856 construction sites active during FY2024 in the construction business.

Priority areas for upstream and downstream activities will be evaluated further, taking into account the questionnaire conducted with major construction-material suppliers and information gathered through Circular Partners (Only in Japanese).

Priority locations for Construction Sites in Operation in Fiscal 2024

Risk and Impact Management

Management Process for Nature-related Issues

| Range of Business | Management Item | Management Technique |

|---|---|---|

| Upstream | Nature-related risks over the supply chain in general |

|

| Important issues (concrete formwork) |

|

|

| Direct operations | Identification of priority locations Nature-related risks Opportunities for restoration of nature |

|

| Downstream | Construction by-products |

|

Metrics and Targets

(1)Metrics and Targets Relating to Dependencies and Impacts

TNFD Global Core Disclosure Metrics for Dependencies and Impacts and Our Record (Fiscal 2024)

| Measurement Metric Number | Causes of Changes in Nature | Metric [Unit] | Measurement Item | Record | Target | |

|---|---|---|---|---|---|---|

| TCFD | Climate change | Greenhouse gas emissions | CO2 emissions | Refer to TCFD | Refer to TCFD | |

| C1.0 | Changes in land, freshwater and ocean use | Total spatial footprint [km2] | Area of construction/business work range | Aggregation of the construction/business work range [See the next item] | - | |

| C1.1 | Range of changes in land, freshwater and ocean use [km2] | Area of changes in land due to construction/business work | Aggregation of the area of changes in land due to construction/business work [See the next item] | - | ||

| C2.0 | Contamination and decontamination | Contaminants released into the soil | (compliance with the Soil Contamination Countermeasures

Act)

|

Zero environmental problems | Zero environmental problems | |

| C2.1 | Wastewater discharge | (Compliance with water contamination prevention-related

laws)

|

Zero environmental problems | Zero environmental problems | ||

| C2.2 | Generation and treatment of waste [t] | (Compliance with construction by-product-related laws)

|

FY2023 | FY2024 | Final disposal rate of less than 3.0% by 2030 | |

| 3.3% | 2.5% | |||||

| C2.3 | Plastic contamination[t] |

|

FY2023 | FY2024 | Final disposal rate for plastics of 15% or less by 2030 | |

| 20.9% | 16.5% | |||||

| C2.4 | Air contaminants other than greenhouse gases [t] | (Compliance with air contamination prevention-related

laws)

|

Refer to Environmental Performance Data* | - | ||

| C3.0 | Use of resources | Amount of water intake and consumption from regions with a lack of water [m3] | (Compliance with water contamination prevention-related

laws)

|

Refer to Environmental Performance Data* | - | |

| C3.1 | Amount of high-risk natural primary products procured from the land, ocean and freshwater [t] |

|

Breakdown by type of formwork plywood (efforts to use sustainable concrete formwork plywood) |

Zero plywood produced overseas(non-certified timber)by 2030 | ||

|

Refer to Environmental Performance Data* | - | ||||

Actual figures on dependencies and impacts will be updated in the Environmental Performance Data section.

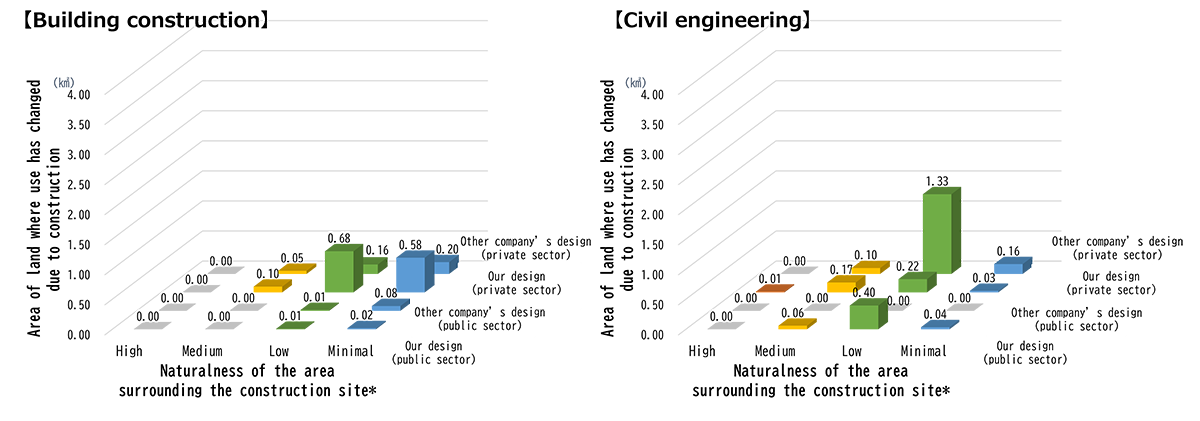

Changes in Land, Freshwater and Ocean Use

Our business activities are closely tied to land use, making this a highly important factor in management decisions. “C1.0: Total Spatial Footprint” aggregates the total area associated with our operations for the reporting year, while “C1.1: Extent of Land/Freshwater/Ocean Use Change” aggregates land areas whose condition has changed due to our activities.

For additional details and figures related to area calculations, please refer to the full report (Only in Jpanese).

C1.1:Extent of Land/Ocean/Marine Use Change = Land Use Changes Resulting from Construction (Projects Completed in FY2024)

C1.1:Extent of Land/Freshwater/Ocean Use Change = Land Areas with Use Changes (Projects in Operation During FY2024)

Naturalness of the area surrounding the construction/business site = A score representing the weighted average of the extent of natural vegetation within a 2 km radius from the center of the construction site, based on area.

High: Within a legally protected area, with a naturalness score of 7 or more (containing a lot of natural vegetation and secondary forests that closely resemble natural vegetation)

Medium: Naturalness score of 4 or more (secondary forests, plantations, grasslands, etc.)

Low: Naturalness score of 2 or more (golf courses, parks, residential areas with lots of greenery, rice fields and farms, etc.)

Minimal: Naturalness score of less than 2 (includes a lot of artificial land use)

Efforts to Reduce Construction By-products

We aim to reduce the final disposal rate of construction by-products to below 3.0% by 2030, including a target of lowering the final disposal rate of waste plastics to 15% or less (currently 20%). These targets are part of our Eco-First Commitments(Updated)(Only in Japanese) under the Ministry of the Environment’s Eco-First Program.

| FY2023 Results | FY2024 Results | Target of FY2030 | |

|---|---|---|---|

| Final Disposal Rate of Construction By-products | 3.3% | 2.5% | Less than 3.0% |

| Final Disposal Rate of Waste Plastics | 20.9% | 16.5% | 15% or less |

Resource Use

For formwork plywood, one of the key upstream issues in the construction business, we conducted a questionnaire survey of partner companies to identify usage volumes by plywood type.

For more information on the questionnaire results, please refer to the full report (Only in Jpanese).

| Formwork Types | FY2023 Results | FY2024 Results | Target of FY2030 |

|---|---|---|---|

| Certified Foreign Plywood | 52% | 58% | - |

| Non-certified Foreign Plywood | 45% | 37% | Zero |

| Domestic Plywood | 3% | 4% | - |

| Non-plywood Materials | 1% | 1% | - |

(2) TNFD Global Core Disclosure Indicators on Risks and Opportunities and Shimizu’s FY2024 Results

| Indicator Number | Category | Indicator | Results |

|---|---|---|---|

| C7.0 | Risks | Assets, liabilities, revenue, and expenditures assessed as vulnerable to nature-related transition risks (total amount and percentage) | - |

| C7.1 | Assets, liabilities, revenue, and expenditures assessed as vulnerable to nature-related physical risks (total amount and percentage) | - | |

| C7.2 | Fines, penalties, or litigation incurred during the year due to negative nature-related impacts (details and amounts) | Not applicable | |

| C7.3 | Opportunities | Capital expenditures, financing, and investments executed toward nature-related opportunities (disclosed by type) | |

| ・Participation in nature-related organizations (membership fees) | 1,435,000yen | ||

| ・Forest restoration volunteer activities | 2,835,000yen | ||

| ・Technology development and research* | 376,700,000yen | ||

| ・Investment in startups and related entities* | 140,000,000yen | ||

| ・Activities supporting a resource recycling society that coexists in harmony with nature | 7,835,000yen | ||

| C7.4 | Increase and percentage of revenue from products and services that deliver demonstrable positive impacts on nature | ||

| ・Volume of contaminated soil transported off-site and treated under the Soil Contamination Countermeasures Act | 34,539m3 | ||

Related R&D themes and investments are selected with consideration for synergy across decarbonization, resource circulation, and nature coexistence.

Comments by Experts

We received comments regarding FY2025 disclosures and future issues from Ms. Kaori Miyake of Sumitomo Mitsui Trust Bank, and Mr. Yoshinobu Muraoka and Ms. Setsuko Yano of Asset Management One.

Based on the comments we received, we plan to deepen our offensive efforts as business creation

opportunities in the future. Moreover, we will position the TNFD recommendations as a means to confirm

our progress on realizing a sustainable society through decarbonization, resource recycling and living

in harmony with nature as we are aiming to achieve by 2050. We will then report our rate of achieving

our targets to our diverse stakeholders.