We believe that information disclosure and dialog with shareholders, institutional investors, and financial analysts is important to achieve sustained growth and increase corporate value of our group.

Enhance constructive dialogue with shareholders, investors, and other stakeholders

1.Policy and Structure of Initiatives

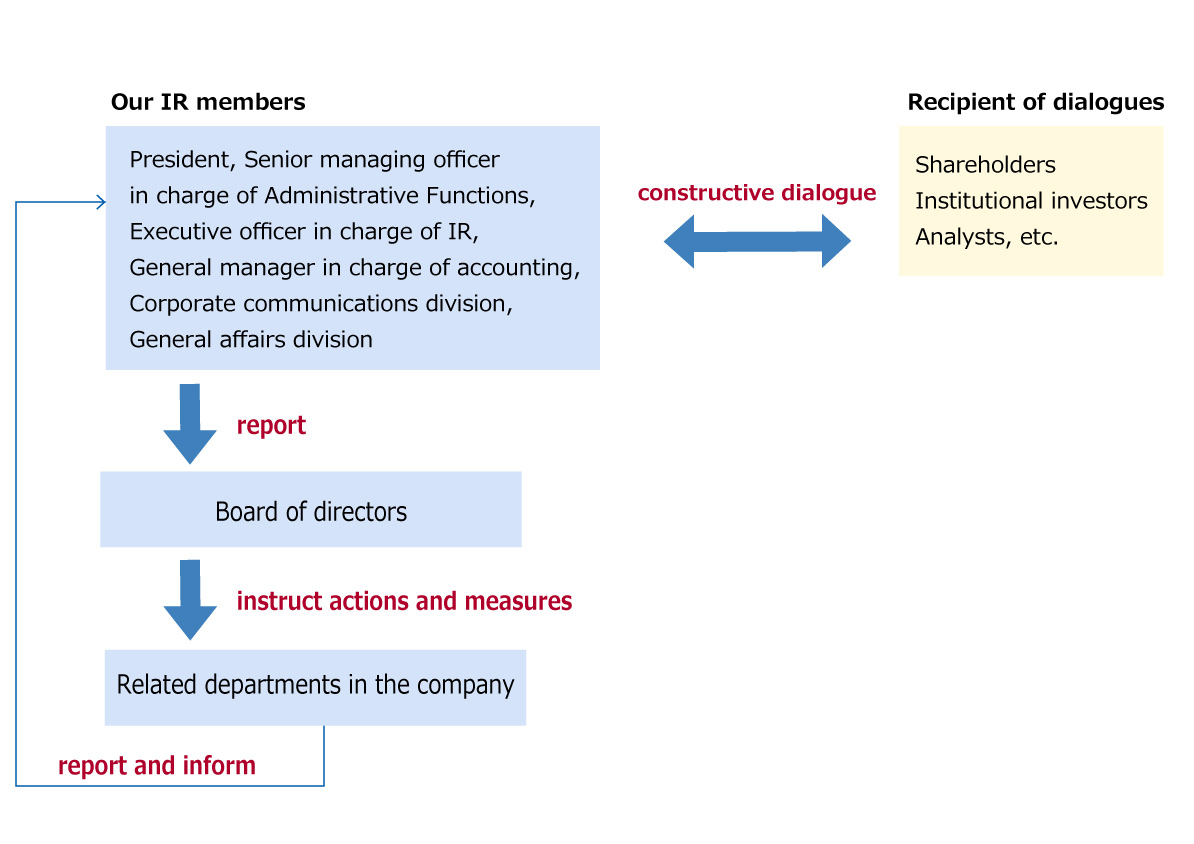

The president, executive officer in charge of IR, and other managements attend financial results briefings and IR meetings to promote constructive dialogue with shareholders and other stakeholders. In other efforts organized by the Company, executive officer in charge of IR and other managements are present to the extent as possible.

The Board of Directors is informed of the opinions of shareholders and investors obtained through IR activities as appropriate. And they instruct relevant internal departments to implement measures necessary for sustainable growth and mid- to long-term improvement of corporate value.

Also, We conduct company facility tours, construction site tours, and various business presentations for shareholders, financial analysts and institutional investors to ensure that they have a clear understanding of our business strategy and management environment.

2. Dialogue and other activities

Activities in FY2024

| Target group | Activities | Counts |

|---|---|---|

| Financial analysts, Institutional investors | Financial results briefings | 4 |

| Business briefing (facility tour) | 3 | |

| IR small meeting | 3 | |

| Individual meetings on financial results | 166 | |

| Institutional investors | Overseas IR roadshow | 11 |

| IR Individual meeting | 34 | |

| Attendance at brokerage conference | 1 | |

| Institutional investors voting officers | SR Individual meeting | 11 |

| Financial analysts, ESG analysts, Institutional investors | SDGs・ESG briefing | 1 |

| ESG analysts, Institutional investors | ESG Individual engagement | 4 |

| Individual shareholders | Business briefing (facility tour) | 1 |

Summary of Individual Meetings for FY2024

Our members

President, Senior managing officer in charge of Administrative Functions, Executive officer in charge of IR, Executive officer in charge of ESG, General manager in charge of accounting, Corporate communications division, General affairs division, etc.

Meeting parties

Institutional investors in Japan and overseas focusing on active management, ESG institutional investors, financial analysts, ESG analysts, etc.

Main Q&A, requests, and dialogue topics

1)Construction business environment

- Trends in the construction market, competitive environment and order profitability

- Strategies for receiving orders, profitability in time of order

- Reasons for profit margin recovery and future outlook

- Impact of and response to rising material prices

- Response to labor shortage

- Status of overseas construction business

2)Real estate/ Engineering

- Status of real estate development business and its return level

- Status of privately placed REIT

- Status of offshore wind power generation business, operation of SEP vessels

3)Capital management policy, shareholder return

- Status of reduction of security holdings and future reduction target

- Capital policy (purchase of treasury shares, growth investments, M&A, etc.)

4)Sustainability, Corporate Governance

- Progress of "Ecology Mission 2030-2050," a mid- to long-term goal for reducing CO2 emissions

- ZEB initiatives and progress

- Role of the innovation and human resources development facility, “Smart Innovation Ecosystem NOVARE”

- Human capital management and human resources strategy

- Status of promotion of female directors and managers

- Methodology of the “Engagement Score” survey and calculation of items and values

- Reasons for the current structure of the Nomination and Compensation Committee and its activities

- Succession plan (succession planning, process for selecting new president)