The Shimizu Group works to ensure continuous and stable development of our business by mitigating risks and minimizing potential losses. We achieve this by identifying various risks we face in operations or other business activities, and appropriately managing them. In the Mid-Term Business Plan 〈2024‐2026〉, we have set “refine sustainability management” as one of our goals, and we are seeking to “take risks while properly risk-hedging”.

Risk refers to all factors that hinder us from achieving our business objectives when managing the business of the Shimizu Group from the following perspectives.

- Factors that may cause direct or indirect economic loss to the Shimizu Group

- Those that may disrupt or suspend the continuation of the Shimizu Group’s business

- Those that may harm the Shimizu Group's reputation and damage its brand image

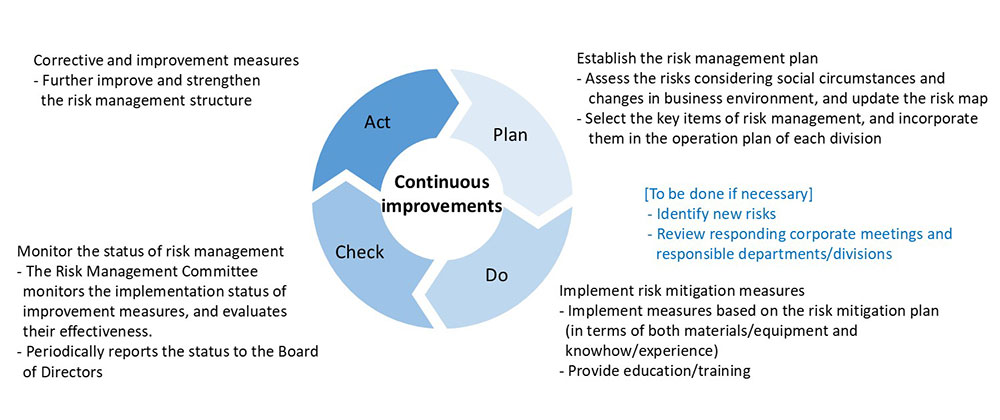

Taking a PDCA Cycle Approach to Risk Management

Risk Management Structure and Risk Management Process

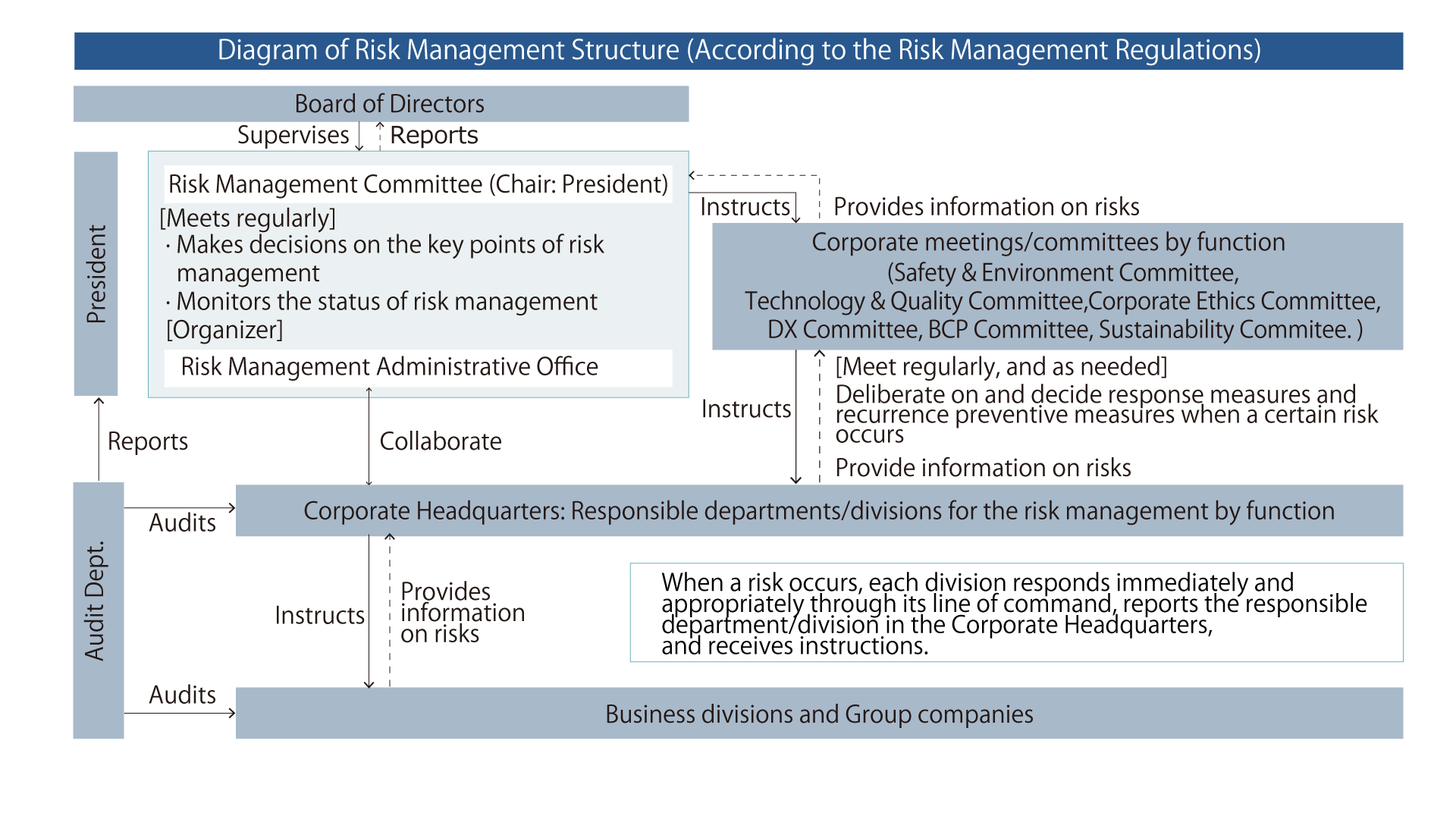

The Shimizu Group annually executes the below risk management process based on the Risk Management Regulations under the leadership of the Risk Management Committee chaired by the President and strives to further improve and strengthen its risk management structure. In addition, recognizing that the relevant risks and issues are wide-ranging, fluid, and volatile, we add new potential risks to our list as necessary and review our risk management structure, response policies, and others.

- Establishing the risk management plan (Plan)

- Implementing risk mitigation measures (Do)

When a certain risk actually occurs and develops into an incident, we report it to the departments/divisions that are responsible for the risk, respond immediately and appropriately, convene the relevant corporate meetings/committees if necessary, and deliberate on and decide response measures and recurrence preventive measures. - Monitoring the status of risk management/Taking corrective and improvement measures (Check/Act)

The Risk Management Committee regularly (twice a year) monitors the status of our risk management with regard to the “key items of risk management” and other risks relevant to various functions of the divisions in the Corporate Headquarters, business divisions, and group companies. The Committee gives instructions on corrective and improvement measures if needed, it strives to respond to newly identified risks, and periodically (twice a year) reports the status of our risk mitigation measures to the Board of Directors.

Risk Management Structure (According to the Risk Management Regulations)

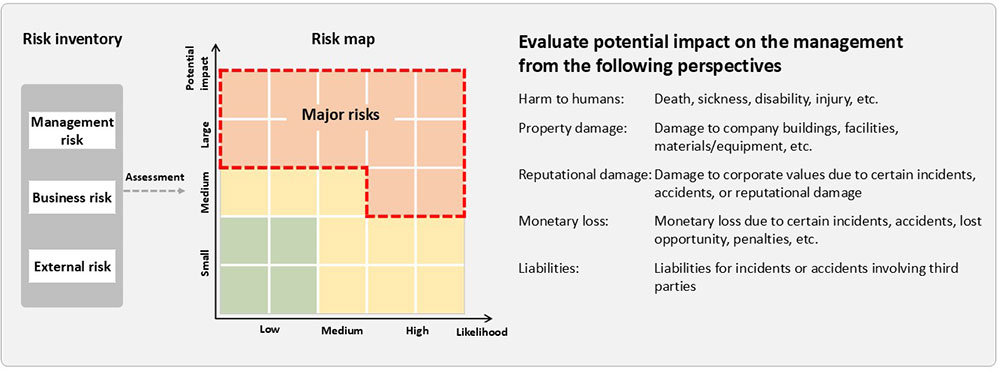

Evaluate the Potential Impact and Likelihood of Occurrence of Each Identified Risk

The Shimizu Group creates and updates the “risk map” with one axis showing the “potential impact on the business” and the other axis showing the “likelihood of occurrence”, based on the risk assessment done by the relevant departments/divisions.

The “potential impact on the business” is assessed from the viewpoints of harm to humans, property damage, reputational damage, monetary loss, and liabilities. The level of impact on our business and operations in case a certain risk materializes and develops into an incident, is comprehensively evaluated from quantitative and qualitative perspectives.

For the “likelihood of occurrence”, the likelihood of a certain risk actually occurring and developing into an incident is evaluated in these categories: an incident which may occur annually, an incident which may occur once in several years, an incident which may occur once in a decade, and an incident we have never experienced before.

When we evaluate various risks, we refer to the past incidents and seek to assess them considering the worst-case scenario for the Company.

Information Security (Basic Policy)

Information Security Policy

Shimizu strives to satisfy its clients through quality construction and relevant services and aims to contribute to the sustainable development of the 21st century society. To fulfill these goals, Shimizu recognizes the importance of utilizing information as efficiently and effectively as possible in order to leverage the company’s full range of available resources. In its use of such information, Shimizu, including its Group companies, are committed to maintaining an appropriate standard for information security.

Information Security Guideline

- Develop an information security management system that complies with international standards, and continuously maintain and improve upon this system.

- For all information under our oversight related to business activities, and all related systems that use this information, we clarify the scope and reasons for protection in order to develop solutions for appropriate information management.

- In order to maintain and continuously improve upon information security, we establish a Corporate Meeting to consistently promote and manage information security throughout the entire company.

- We work to expand and deepen the understanding and knowledge of information security amongst our employees and affiliates through educational and informative initiatives.

- By conducting regular audits and assessments regarding information security, we identify and confirm new and emerging risks, as well as assess external environmental changes, in order to continuously manage these risks.

Management and Protection of Personal Information

We established our Privacy Policy in 2005 and are committed to protecting personal information.

Privacy Policy (Guidelines on protection of personal information)

Information Security Initiatives

In accordance with our Information Security Guidelines, we are working to improve our security robustness, including the prevention of information leaks. The details of the revisions are communicated to all relevant parties, and incorporated into the contents of internal training materials.

We are seeking to raise awareness of information security of all our employees, including ensuring that they know how to deal with targeted attack emails. We are also collaborating with business partners for construction projects and continuously working to refine the information security system.

Business Continuity Plan (BCP)

Basic Principles

In recent years, changes in the natural environment such as climate change and global warming have precipitated natural disasters that cannot be responded to with existing practices. We have implemented many measures to counteract various disasters in the past, and have formulated a business continuity plan (BCP) to prepare for the occurrence of critical events of a level which we are unable to respond to with the existing outlines of countermeasures. The plan is revised as needed.

In cases of natural disasters, our mission is to secure the safety of citizens residing in areas affected by the disaster and to preserve the foundation for living and the foundation of society. In our BCP, we focus on promptly preserving our workplace and facilities, supporting the recovery and restoration of the affected areas, and supporting our clients to restart their businesses as quickly as possible.

In order to act promptly under such circumstances, our individual employees must understand their roles and act independently and responsibly. Additionally, we must have a corporate structure which is able to quickly adapt to new situations. In accordance with the points above, our BCP policy is established as below:

BCP Basic Policy

- Prioritize ensuring and confirming the safety of our employees and their families

- Strive to preserve our facilities and job sites where construction is in progress

- Assist recovery work of clients’ facilities (properties constructed by Shimizu)

- Contribute to ensuring the living foundation for society and community

- Create a structure that allows workers that are involved in preservation activities to act independently

Identifying Risks and Estimating Potential Damages

Critical events caused by “extremely severe disasters” such as natural disaster and the like which are highly likely to impact our business activities in wide-ranging areas including disruption/suspension of headquarters functions are identified as risks.

Conducting BCP Drills to Prepare for an Earthquake Directly Beneath the Greater Tokyo Area

As the types of natural disasters become more varied and increase in duration and intensity, we must consider responses to risks that were not foreseen in conventional business continuity planning (BCP). Shimizu also revised its BCP to respond to such new risks, and conducted a company-wide BCP emergency drill on March 11, 2019 based on the scenario of an earthquake directly beneath the Greater Tokyo Area. The scenario of the drill was a magnitude 8 earthquake with a seismic intensity of 7 occurring at 2:00 am under the northern part of Tokyo Bay. In the scenario, the area surrounding the head office suffered catastrophic damage and headquarter functions had become inoperable.

It was determined that establishing an emergency response headquarters at the head office would be impossible in such conditions, so an alternate headquarters was temporarily established at the Kansai Branch in Chuo-ku, Osaka, and directed company-wide response activities until head office functions were restored. As was the case in previous drills, the safety of employees was confirmed and information on damage to Shimizu facilities, job sites, and customer facilities was collected as part of the drill response. A new part of the drill in which the Kansai Branch took over the head office functions of wage payment and processing of customer payments was also conducted until it was handed back to a functioning Tokyo office three days later. We will continue these drills in the future to strengthen our ability to respond in an emergency.

Promoting Disaster Prevention Activities Together with the Community

At the request of Chuo-ku (Tokyo) authorities, our Headquarters Building is designated as a regional disaster center and will provide space to temporarily shelter people who cannot return home. We have a system to operate the regional disaster center in place and are committed to contribute to a disaster prevention system based on the philosophy of “mutual help” together with Chuo-ku and other companies.

Risks Affecting Our Business

| Overview of major risks | Main mitigation measures/initiatives | Likelihood | Impact | |

|---|---|---|---|---|

| (1) | Risk of ethical and legal violations The construction industry, which is the main business field of the Group, is subject to various legal regulations, including the Construction Business Act, the Building Standards Act, the Real Estate Brokerage Act, the National Land Use Planning Act, the City Planning Act, the Antimonopoly Act, and various laws related to safety, the environment, labor, and harassment. If an illegal act were to take place within the Group, it could affect our business performance or corporate valuation. |

We put into practice the Credo, The Analects and the Abacus, and the entire Group works to reinforce ethical awareness and ensure thorough compliance. (Main initiatives)

|

Low to Medium | Medium to Large |

| (2) | Risk of safety and environmental incidents Accidents causing injury or death, environmental contamination/defects, violation of environmental laws and regulations during the construction may lead to a large amount of repair costs, construction delay, business restrictions due to criminal or administrative penalty and the like, and are likely to impact our business results and corporate valuation. |

We share the basic principles of “safety first,” “respect for human life,” “prevention of environmental contamination,” and “biodiversity conservation” within the Company, and strive to raise awareness of safety and the environment. (Main initiatives)

|

Low to Medium | Medium to Large |

| (3) | Risks related to technology and quality Serious accidents and defects related to technology and quality triggering serious contractual non-conformity may cause large repair costs, construction delays, reputational damage and the like, and are likely to impact our business results and corporate valuation. |

We share our business principles of “customer first” and “quality assurance” within the Company, and strive to further improve quality control. (Main initiatives)

|

Low to Medium | Medium to Large |

| (4) | Risk of shrinking construction market If private capital investment were to decrease due to recessions in Japan or overseas, or if public investment were to be reduced to restore the country's fiscal health, it could affect future order awards. |

Every month the Board of Directors reviews the outlook of order awards for the construction business and the potential projects volume, and provides instructions on necessary measures at the Executive Officers’ Meeting and Division Directors’ Meeting. We set the change of our target revenue structure in SHIMZ VISION 2030, our long-term vision looking ahead to 2030, and we are implementing growth strategies for each line of business according to the Mid-Term Business Plan 〈2024‐2026〉. |

Medium | Large |

| (5) | Risk of workforce shortage The skilled workers who are essential for the construction industry are aging. If there isn’t a new generation of workforce by the time baby boomers retire in large numbers, it could compromise our operations, thereby affecting our business activities and performance. |

Through public-private partnerships, we are working to secure and train workers, improve their treatment, and make the construction industry more appealing. (Main initiatives)

|

High | Large |

| (6) | Risk of fluctuation in construction material prices and labor costs If construction material prices, labor costs, or other such expenses were to increase significantly and more than anticipated after contracts are signed and it were to be difficult to reflect that increase in the contract price, it could lead to an increase in construction costs and worsen the profit and loss situation. |

We strive to reduce risks by conducting rigorous pre-order award screening and clarifying the scope of work when submitting estimates. In principle, when signing contract agreements with clients, we strive to always discuss adoption of provisions related to changing the contract amount based on fluctuations in labor wages and construction prices (i.e., a sliding scale clause). |

High | Medium |

| (7) | Risks associated with long working hours The construction industry as a whole is facing chronic labor shortages. Especially during busy periods, there is the risk of long working hours for staff as workload concentrates on specific employees. If such a situation continues, it may not only adversely affect the safety and health of our employees, but may also adversely affect our business operations, including reduced motivation and productivity, and the eventual loss of talent. |

In order to obtain accurate information about working hours and attendance and improve the situation, we established a labor management structure including introduction of new systems. We also have in place an appropriate structure to take care of employees’ mental health, such as posting sufficient occupational health specialists and holding visiting interviews with staff at work sites. Additionally, in order to avoid excessive workloads, we are working to improve efficiencies and level out workloads through front-loading activities, work sharing, outsourcing, and others. In addition, we regularly examine employee engagement scores, and closely monitor implemented controls such as if site offices are closed 8 days per 4 week periods and if workers are taking appropriate leave. In this way we seek to accurately grasp the current work environment and improve it further. | Medium to High | Medium to Large |

| (8) | Risks related to order awards and contracts If contract agreements contain extremely strict conditions or ambiguous clauses, we may not be able to secure the intended profits. |

We strive to conclude contract agreements on appropriate terms and conditions by closely examining the policies and contract conditions of each project at company-wide corporate meetings, for both domestic and overseas construction business. In addition, we are sharing the information on the revisions to the Construction Business Act that mandate contractors to provide the information on relevant risks to employers, and provide guidance on how to respond, and we are ensuring all employees are complying with them. (Main initiatives)

|

Medium to High | Medium to Large |

| (9) | Risks related to asset holdings The Shimizu Group invests in businesses such as real estate development business, PFI business, and the renewable energy business. We also make strategic investments in facilities including fixed assets for our own use and DX related facilities. If the relevant business environments were to change significantly, such as a slowdown in the market, fluctuations in the financial markets, and an increase in prices and personnel expenses, it could affect our business performance. |

We establish annual investment plans to operate within a risk range that is in line with our corporate strengths. As for individual investments, we invest in a calculated manner including having pre-defined exit strategies (investment recovery plans), based on investment criteria. The Board of Directors regularly follows up on the progress of each line of business, investment balance, business portfolio, and market value, and takes measures as necessary. | Low | Large |

| (10) | Risks related to changes in the international affairs If there were to be significant changes in the political or economic conditions, exchange rates, tax systems, legal regulations, or others in foreign countries, or if acts of terror, war, or riots were to occur, material prices and labor costs were to rise substantially, or a strain in the labor supply were to arise, it could affect our domestic and overseas businesses and financial condition. |

When developing business overseas, we narrow down the list of regions and countries based on business opportunities and country risks, and take the necessary measures. In the domestic construction business, we are reviewing the excessive dependence of supply chains on specific countries or regions to diversify and optimize risks. (Main initiatives)

|

Low | Large |

| (11) | Risk of leakage of confidential information If confidential information acquired through our business activities was to be leaked, it could affect our business performance and corporate valuation. |

By establishing a Privacy Policy and rules/regulations to protect personal information, and appointing a Corporate Personal Information Protection Administrator, we are properly managing personal information and implementing various measures to address information security risks. (Main initiatives)

|

Medium | Medium to Large |

| (12) | Cybersecurity risk If we were to fall victim to a cyberattack such as a targeted e-mail attack or malware attack leading to viral infection or unauthorized access, it could affect our business activities or corporate valuation. |

We have established the DX Committee to discuss matters related to information security and take the necessary measures. (Main initiatives)

|

Low | Large |

| (13) | Risk of natural disaster/infectious disease If a natural disaster such as an earthquake, tsunami, storm or flood damage, or a pandemic were to occur, it could result in direct damage to the Group’s assets or employees and affect our business activities. If the disaster were to be large in scale, the changes in the business environment such as changes in order awards circumstances, soaring construction material prices, and decreased electric power/energy supply capacity could affect our business performance. |

We established the BCP Committee to continuously review our BCP, determine training plans, and follow up on the status of implementation. (Main initiatives)

|

Low | Large |

| (14) | Risks related to climate change If average temperatures were to increase or climate disasters were to become more frequent or intense as physical effects of climate change, it could affect the operations of construction sites which are core to our business. If regulations were to become stricter with regard to construction of new buildings, land alterations, use of materials derived from natural resources, and others, in order to shift society to more decarbonized and in harmony with nature, it could reduce the demand for new construction. Or, if carbon offset markets get established to achieve carbon pricing or nature positive, or a similar event occurs, it could increase the costs and have a financial impact. |

We have been disclosing financial information based on the Task Force on Climate-related Financial Disclosures (TCFD) Recommendation since 2020, and also based on the Taskforce on Nature-related Financial Disclosures (TNFD) Recommendations since 2024. We have been analyzing risks and opportunities related to climate change and nature and studying response measures. The Sustainability Committee (chaired by the President) deliberates and decides on response measures, and the Board of Directors ensures that they are in line with our business strategies. (Main initiatives)

|

High | Medium |

| (15) | Risks related to creation, revision, or repeal of laws If new laws and regulations were to be enacted or existing laws were to be revised or repealed due to changes in society or the times, it could affect our business performance or corporate valuation. |

To properly respond to establishment of new laws or revision/repeal of existing ones that affect our business activities, we have prepared our own rules and regulations, provide notice through various corporate meetings, company intranet, and other means, and are implementing internal education and training (including e-learning). | Medium | Large |

| (16) | Risks associated with fluctuations in financial markets If financial markets become dysfunctional due to deteriorating financial/economic situations in Japan and abroad, it could lead to restricted availability of funds and increase in funding costs. If the interest rates suddenly go up or there are drastic fluctuations in the exchange markets, it could affect our business performance. |

Through timely disclosure of information to our main financial institutions, we seek to secure their understanding of our business, and maintain and further improve close relationships. We also have commitment lines and spot borrowing limits in place in order to secure liquidity in case of an emergency. | Low | Large |

| (17) | Risk of fluctuation in price of investments in securities If the value of investments in securities were to drop significantly, it could affect our financial standing. |

The Board of Directors comprehensively examines the necessity of securities holdings of individual stocks each year, taking into consideration their economic rationality, including the cost and risk of holding them, and potential business development benefits. Regarding shares which don’t give much benefits any more according to the examination, we reduce the relevant securities holdings to promote effective utilization of capital, while ensuring it doesn't impact relationships with clients/business partners. | Low | Medium |

Key Items of Risk Management for FY2025

Items which require daily control and monitoring are selected from “major risks” as the “key items of risk management”, and they are incorporated in the operation plan of each division. Its management status is regularly monitored.

- Risk of ethical and legal violations

- Risk of safety and environmental incidents

- Risks related to technology and quality

- Risks associated with long working hours

- Risks related to order awards and contracts

- Risk of leakage of confidential information and the like